November 2025

What You Need To Know

After Utilities had trailed the broader market (MSCI World index) in Q3 2025, the MSCI World Utilities extended in October the rebound from September and gained 3.0%, thereby beating the MSCI World benchmark by 1%. The solid outperformance was driven by European Utilities, which jumped more than 7%, while US Utilities (DJ Utilities) lost steam and finished the month of October with a small loss of 0.6%. The strong October performances from European Utilities seem to anticipate solid Q3 2025 results in November on the back of renewable capacity growth and rising network earnings. YTD in 2025, the MSCI World Utilities has outperformed the broader market by almost 500 bps and European Utilities have posted the strongest YTD sector gains (twice the return of US Utilities, see Table 1). In addition, the S&P Global Clean Energy index jumped 11.8% in October and extended the YTD gain to 50%, which partially reversed the heavy losses over the past four years.

Table 1 Index Performances

Similarly, the strong YTD performances of our equal-weighted European Utilities sub-sector indices, which have posted YTD returns between 20% and 35%, except for UK Water Utilities, see Table 1), reflect the outperformance of European Utilities so far this year. Among our European sub-sectors, “Gas Networks” and “Power Generation” have posted the strongest YTD returns with more than 30% share price gains. However, by jumping 7.4% in October, our “UK Water Utilities” index erased the YTD loss until the end of September. Meanwhile, our “Wind Energy Equipment” and “Solar Energy Equipment” indices added another 6.2% and 10.2% in October, respectively, as wind turbine companies start to benefit from price stabilization and rising margins. Among our Regional Utilities indices, Japan leads the performance (YTD 16.7%) as Japanese Utilities have also benefited from the “Takaichi trade” in October (see “Power Points” on page 8).

Exhibit 1 Rebased Index Performances since 2024

Source: Thomson ONE (Performances as of 31 October 2025)

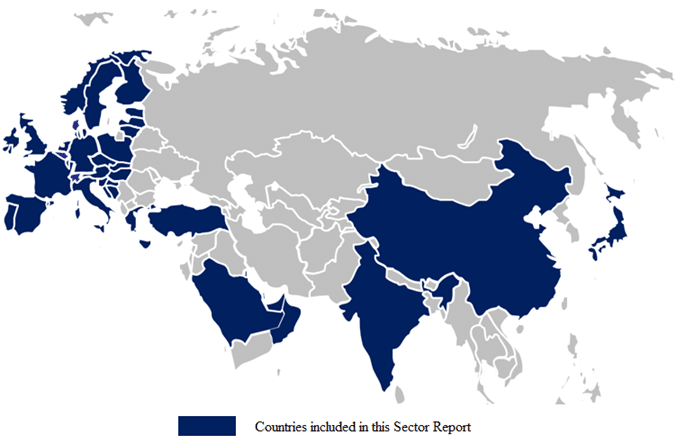

Monthly Focus: The Balance of Power in the Middle East

What is driving Middle East Power Demand? Between 2000 and 2024, electricity consumption in the Middle East has tripled (at a CAGR of 4.9%) and has grown by more than 1,000 terawatt-hours (TWh) to reach 1,537 TWh in 2024. Looking ahead, power demand is projected to rise by 50% until 2035 and to grow thereafter at a CAGR of 4.7% to reach 4,721 TWh until 2050 (based on demand forecasts from the Int’l Energy Agency in the Announced Pledges Scenario, or APS). This makes the Middle East region the third-largest contributor to global electricity demand growth after China and India.

The drivers for this strong power demand growth are the region’s extremely hot temperatures (normally exceeding 40° Celsius) and water scarcity, which implies that the power generation sector has become a crucial industry for sustaining everyday life and economic growth in the Middle East region. Power used for cooling already accounts for one-quarter of annual electricity consumption in the Middle East and is expected to be the largest demand driver by 2035.

In addition, the Middle East faces extreme water stress as it produced 12 billion cubic meters (bcm) of desalinated water in 2024, and this amount is projected to triple by 2035. While thermal desalination has historically been fueled by oil and gas, it will increasingly depend on electricity-powered, high-efficiency reverse osmosis technologies in the future. Until 2035, cooling and desalination are expected to account for close to 40% of projected power demand growth in the Middle East, with additional demand coming from the electrification of the housing and industrial sectors, from data centers as well as from producing and exporting hydrogen.

While the Middle East currently hosts only around 750 MW of installed global data center capacity (around 1% of total global capacity), recent announcements point to the potential for substantial capacity growth as Oman and Saudi Arabia have created special economic zones to provide fiscal permitting and lower power prices for data centers and digital infrastructure.

The region’s hot climate has been a disadvantage for conventional data centers, but more efficient liquid cooling technologies can solve this issue and make the Middle East an attractive destination for AI-focused data centers. In May 2025, UAE telecommunications firm G42 announced a 5 GW data center campus and Saudi AI firm HUMAIN, owned by the Public Investment Fund, announced projects equivalent to 1 GW of capacity. If these gigawatt-scale projects materialize, they could significantly increase the current outlook for electricity demand growth from data centers in the region.

How will the Middle East Power Supply Mix change? While Middle East power supply is still heavily reliant on oil- and gas-fired power generation (71% came from gas and 20% from oil in 2023), the electricity generation mix is expected to become much more diversified over the next years. The declining role of gas in most countries is driven by the rapid deployment of low emissions renewable technologies, led by solar PV and complemented by growing contributions from wind power, mostly in Oman and Saudi Arabia, and from nuclear energy in the UAE. As a result, under the APS, the share of gas-fired generation will decline to 28% by 2050, displaced by a rising share of wind and solar energy, which are projected to reach 49% and 14%, respectively (see Exhibit 2).

Exhibit 2 Middle East Energy Mix in Power Generation

The growing share of cost-competitive solar power in the Middle East electricity mix is driven by the decline of levelized cost of electricity (LCOE) for utility-scale solar PV, globally but in particular in the Middle East region. While the average global LCOE for solar power is projected to drop by 40% from 2023 levels to below USD 30/MWh by 2035, recent auction prices for large and best-in-class utility-scale solar projects have been significantly lower in the Middle East.

In 2025, solar Power Purchase Agreements (PPAs) were awarded at extremely competitive LCOE of USD 14/MWh in the UAE and for USD 12.9/MWh in Saudi Arabia, which can be attributed to superior irradiation levels and as well as to favourable country-specific conditions, such as low labour costs, advantageous land and financing conditions as well as state ownership. These very competitive LCOE for utility-scale solar projects compares to three times higher LCOE of USD 45-46/MWh for gas-fired electricity from combined-cycle gas turbines (CCGT), which were also paid in Saudi Arabia for four gas PPAs from gas plants in 2025.

What are the Investment Needs in the Middle East Power Sector? Stable power supplies from resilient power systems are fundamental to sustaining daily life in the Middle East. In addition to investing in power generation capacity, significant grid upgrades will also be essential to support the rapid electrification of the housing and industrial sectors as well as to integrate the growing share of renewable energy into the power system.

The Gulf Cooperation Council (GCC) Grid links the power systems of Bahrain, Iraq, Kuwait, Oman, Qatar, Saudi Arabia and the UAE into one power network. The network is managed by the GCC Interconnection Authority, which was established in 2001 and is based in Saudi Arabia. Over the past decade, the Middle East has witnessed a substantial expansion of its power infrastructure, with transmission lines expanding by 76% in length (kilometers) and distribution lines by 66% (compared to global averages of 36% and 28%, respectively). Going forward, growth rates should remain robust, with transmission and distribution line kilometers growing by 60% and 80% by 2035, respectively, to meet the electricity demand forecasts under the APS.

In 2023, the Middle East invested a total of $40 billion in the power sector annually, with about 55% accounting for power grids & storage, 25% for thermal (fossil fuel) generation capacity and only about 15% for renewable energy capacity. To meet the strong electricity demand growth forecasts under the APS, the IEA projects that annual power sector investments will more than triple to about $126 billion in 2035 and that 50% of that capex will go to renewable capacity, 40% to power grids & storage and only 10% will be spent on thermal (fossil fuel) capacity (see Exhibit 3). In 2035, roughly $45 billion will be spent annually on wind & solar capacity ($25 billion for wind and $20 billion for solar) and about $55 billion for Power Grids & Storage (the majority, or $35 billion, on distribution networks).

Exhibit 3 Annual Power Investments in the Middle East

Power Points

EUROPE

Q3 price trends for wind & solar in the USA and in Europe

According to data from LevelTen, average prices for Power Purchase Agreements (PPA) for electricity generated from wind & solar energy have increased by >4% QoQ to $67/MWh in the USA in Q3 2025. The increase has been slightly more pronounced in onshore wind (+5%) than in solar (+4%). For solar, rising costs have been the main driver for the PPA price increase (with import tariffs on steel, aluminum and copper taking effect). For onshore wind, rising costs linked to import tariffs along with more permitting uncertainty have driven the PPA price increase. As US power demand remains strong (from Tech companies and AI data centers), less electricity supplied from wind and solar is lifting PPA prices for green electricity.

Conversely, average onshore wind & solar PPA prices in Europe have declined by about 1% QoQ in Q3 2025, with onshore wind prices staying flat and prices for solar energy declining by more than 2%. LevelTen highlights two reasons for the decline in solar PPA prices: first, weaker demand relative to growing supplies in many European countries, and second, growing solar price cannibalization in several countries. In contrast, onshore wind PPA prices were more resilient as they have suffered less from price cannibalization. Finally, LevelTen sees a gradual rise in hybrid PPAs (for solar and batteries) in Europe and said that electricity demand has strongly increased in countries with data center locations (such as Finland, Spain and Ireland).

Engie signs solar PPA with Meta in Texas

Engie has signed a power purchase agreement (PPA) with tech company Meta Platforms for its 600 MW Swenson Ranch solar farm in Texas. The facility is expected to be operational in 2027 and Meta will purchase the project’s entire power output to support its data center operations in the US. The deal brings the PPAs between both companies to more than 1.3 GW across four projects in Texas. The €775 million Swenson Ranch project, located in Stonewall county, will be the largest asset in Engie’s North America portfolio, which consists of more than 11 GW of solar, wind and battery storage assets. The deal highlights that Engie continues to develop solar assets in the US despite regulatory uncertainties related to legislation and tariffs, which appear to be reflected in the project’s higher construction costs (€1.3 million per MW).

RWE builds Germany’s largest battery system

RWE has started building what it says will be Germany’s largest battery energy storage system (BESS) in Grundremmingen (Bavaria), a facility of 400 MW/700 MWh, which will be installed at a cost of about €230 million (or €0.58 million per MW). The BESS will be located at the site of a decommissioned nuclear power station and will use the existing grid connection. Its operations will help to stabilize the German grid by delivering power continuously for almost two hours. The facility will be equipped with over 200 containers housing around 850,000 lithium iron phosphate battery cells, which will be installed over the next few months and commercial operations will start in early 2028. In addition to the BESS, the site will also accommodate a 55-hectare solar park and a gas-fired power station. This site is a good example of the competitive advantage that RWE has from keeping the connection rights in decommissioned power plants.

Spanish regulator slightly raises allowed return proposal

The Spanish regulator CNMC submitted to the State Council a new draft proposing a 6.56% return for transmission, system operation and distribution in the regulatory period 2026-31. This represents only a very small (12 bps) improvement to the 6.46% that CNMC had initially proposed in July, which is significantly below the >7% that the affected companies had asked for to incentivize investments. This regulated return is relevant for Redeia (Spanish transmission operator) and for the largest distribution companies Endesa (parent Enel), Iberdrola, Naturgy and EDP. The proposed rate reflects a real return of about 4.56% (after about 2% inflation), which is lower than the allowed returns in the UK (about 4.5%-4.7% for transmission) and in Italy (about 5.5%-6.2% for different activities). The low return proposal may affect the relative attractiveness of power grid investments in the Spanish market.

Redeia beats at bottom line and maintains full year guidance

The company reported an EBITDA of €950.9 million, which reflected an increase of 3.0% YoY in 9M 2025 (and was in line with expectations) as the Spanish Transmission business delivered 3.9% YoY EBITDA growth. As expected, in the International segment the decline in operating profits started to stabilize from H1 2025 as forex headwinds have started to decelerate. Net income declined by 4.6% YoY to €389.8 million in 9M 2025 (but 4% ahead of consensus) as financial costs and taxes increased. As usual in Q3, there was no conference call scheduled and the full year guidance was confirmed: EBITDA of >€1.25 billion, net profit of >€500 million, capex of >€1.4 billion and net debt at about €5.7 billion by the end of 2025.

Endesa delivers strong profit beat but maintains full year guidance

Endesa reported strong earnings growth across the board for 9M 2025: a 9% YoY increase in EBITDA to €4,224 million (2% above consensus), an 11% higher EBIT of €2,545 million (3% better than expected) and a 26% YoY jump in net ordinary income to €1,735 million (8% consensus beat). EBITDA growth came from an increase in thermal power generation and higher gas margins, which more than offset the 4% decline in electricity network EBITDA. Lower financial costs supported the profit jump at the bottom line. Despite the strong profit increase (and profit beat), management left the full year 2025 guidance range unchanged: EBITDA of €5.4-€5.6 billion and net income of €1.9-€2.0 billion. But management reiterated in the call that it expects to “very comfortably” hit the upper end of the guidance range after the strong set of 9M results.

Iberdrola beats and raises full year guidance

Iberdrola released 9M 2025 results, which beat consensus expectations, as the company reported a 6% YoY decline in EBITDA to €12.44 billion (3% ahead of consensus) and a 3% YoY decrease in net profit of €5.31 billion, which was 7% ahead of expectations. While the Networks EBITDA was lifted by strong growth in Spain (one-offs), in the UK (RAV growth), in the US (positive rate cases) and in Brazil (inflation), the EBITDA in Generation & Customers benefited from a UK capital gain. In addition, just a month after the CMD in September, the company surprised and raised its full year 2025 net profit guidance from mid-to-high single to now double-digit net profit growth, adjusted for one-offs (€382m gain from the sale of its UK smart meters business).

Italgas: Beat and raise in 9M 2025, provides strong growth outlook

Italgas 9M 2025 results surprised to the upside: Adjusted EBITDA came in at €1,406 million (5% above consensus) and adjusted net profit reached €495 million (4% above consensus). EBITDA from core gas distribution activities was up 35% YoY to €1,336 million and Water and ESCO EBITDA was up 28% YoY to €57 million. The full year 2025 guidance was raised: Revenues expected at €2.5 billion (previously €2.45 billion, consensus at €2.49 billion), adj. EBITDA of €1.87 billion (prev. €1.80-1.85 billion, consensus at €1.91 billion and adj. EBIT at €1.19 billion (prev. €1.12-1.16 billion, consensus at €1.22 billion). As part of the Strategic Plan 2024-31, the company also provided a guidance for FY 2031: adj. EBITDA of €3 billion, adj. EBIT of €2 billion and net debt of €20.3 billion. The company is guiding for 10% EPS CAGR over FY2024-31 and an extension of its dividend policy (the higher of 5% annual growth or 65% payout out ratio) until FY 2028 with FY 2024 as the starting point.

UK Water: CMA review for UK water companies

On 9 October, the UK Competition and Markets Authority (CMA) released its provisional re-determination for 5 UK water companies, which had appealed the previous regulatory determination of the Water Services Regulation Authority (OFWAT). These companies were Anglian Water, Northumbrian Water, South East Water, Southern Water and Wessex Water. The companies had requested £2.7 billion in additional revenues of which the CMA provisionally allowed £556 million resulting in customer bills increasing by 3% on top of the 24% allowed by OFWAT. However, the CMA largely rejected the companies’ funding requests for new activities beyond what was already allowed by OFWAT, except in situations when the additional spending would result in consumer benefits. For the allowed return, CMA used a higher inflation (CPIH and beta) than OFWAT, resulting in an allowed ROE of 5.9% CPIH vs 5.1% by OFWAT. The final CMA decision deadline is 17 March 2026.

UK Water: Increase in serious pollution incidents in 2024

On 23 October, the UK Environment Agency published the EPA (Environmental Performance Assessment) results for 2024, based on its EPA stars system, ranging from 1 star (poor) to 4 stars (industry leading). Among the listed water companies, Severn Trent achieved 4 EPA stars for the sixth consecutive year. United Utilities received only 2 EPA stars due to pollution incidents from power failures compared to previously consistently receiving 3 or 4 EPA stars. South West Water (Pennon) received 2 EPA stars, which it has consistently received for the last 3 years. Overall, the UK water sector scored 19 EPA stars, down from 25 stars in 2023, mainly because of tighter assessment criteria and a 60% increase in serious pollution incidents to 75 incidents (with Thames Water, Southern Water and Yorkshire Water accounting for most of the incidents). However, the UK Water sector has generally improved since 2011, when the UK Environment Agency introduced the EPA stars system.

MIDDLE EAST:

Engie develops Abu Dhabi’s new 1.5 GW solar plant with Masdar

Engie continues to grow its renewables footprint in the Middle East. Emirates Water and Electricity Company (EWEC) has awarded the development of its new 1.5 GW Khazna Solar Photovoltaic (PV) project to Engie and Masdar, which will power 160,000 homes. Located close to Al Khazna in Abu Dhabi, the Khazna Solar PV project is part of EWEC’s strategy to expand Abu Dhabi’s solar capacity to 18 GW by 2035 and meet 60% of the Emirate’s power demand from renewable and clean energy sources.

ADNOC GAS held its first-ever “Investor Majlis”

As part of ADNOC’s six listed subsidiary companies, ADNOC GAS participated in the “Investor Majlis”, which ADNOC launched in October as a new format to foster a direct and transparent dialogue with investors and analysts. To meet the strong gas demand forecasts from 2023 until 2030 (CAGR of 4-5% in the local market and 1.5x growth in the Asian market), ADNOC intends to grow its gas and liquids capacity by 30% until 2029 with an ambitious $20 billion capital spending program until 2029. Three projects, which are currently under construction, provide a clear path to grow EBITDA by 40% from 2023 until 2029. Based on its low gearing with a projected net cash position in 2026 (see Table 4 with Valuations at the end), there is ample room for financing these ambitious growth plans and simultaneously grow the dividend. Therefore, the company extended its 5% per year dividend growth target until 2030 with the goal to allocate total dividends of $24.4 billion in 2025-30 (quarterly dividend payment will start in Q3 2025).

Saudi Electricity Company signs strategic agreements to develop the Saudi power market

At the ninth Future Investment Initiative (FII9) (held on October 27-30 in Riyadh), the Saudi Electricity Company (SEC) has signed several strategic agreements exceeding $4 billion, which will help SEC to increase the efficiency and sustainability of the Kingdom’s power sector and to accelerate the implementation of strategic electricity and infrastructure projects to support the Kingdom’s Vision 2030 development goals. Of that, $3 billion was signed with a consortium of leading global banks to strengthen SEC’s liquidity position and to broaden its global financing base to support large-scale projects in power generation, transmission and distribution across the Kingdom. An additional $1 billion Export Credit Agency (ECA) framework agreement was signed with Swiss Export Risk Insurance (SERV) and Standard Chartered Bank (SCB) to support SEC’s strategic initiatives through ECA-backed financing, with a focus on enhancing Saudi and Swiss content in project execution.

JAPAN:

Japan: Impact of “Takaichi trade” on Japanese Utilities

After Ms. Sanae Takaichi became Japan’s first female Prime Minister, Japanese equities rallied in anticipation of more growth-oriented fiscal spending, which could also affect Japanese utilities companies in two ways: First, as Ms. Takaichi’s policy focus is raising Japan’s security in different areas, such as military, economic and energy, the expectation is that Japan will invest more in nuclear energy to increase the share of nuclear power in the country’s electricity mix (currently, nuclear energy accounts only for 10%, see Exhibit 40), which will benefit Japanese utilities with exposure to nuclear energy, such as Kansai, Kyushu and Okinawa, see Table 4). Second, the expectation of more fiscal stimulus also implies higher long-term interest rates (i.e. a steeper yield curve), which would be seen as a negative because Japanese utilities companies have relatively high gearing levels (Net Debt/EBITDA of 7-13x, on average 8.7x, see Table 4 at the end).

Kansai Electric raises 9M profit guidance and full year dividend target

Kansai reported a 1.8% increase in reported profit to JPY 232.9 billion in H1 2025/26 and raised the profit guidance for 9M 2025/26 from JPY 400 billion to JPY 490 billion (above consensus of JPY 442.4 billion). The main factors for the improved profit outlook are: stronger profit growth in the energy business (JPY 50 billion ahead of the previous plan) and higher contributions from transmission/distribution businesses (JPY 38 billion above the previous plan). The full year 2025/26 DPS guidance was raised to JPY 75 (from JPY 60). In terms of shareholder return policy, the company is considering a target dividend payout ratio of 25-30% to maintain stable dividends.

Chubu Electric announced H1 2025/26 results

Adjusted reported profit fell to JPY163.2 billion from JPY 188.9 billion a year ago. The profit decline came from lower earnings at Miraiz (the retail electricity sales business), JERA, and from losses related to withdrawing from the offshore wind power generation business. The company kept the profit guidance for 9M 2025/26 unchanged at JPY 230 billion, below the JPY 256.5 billion consensus. Meanwhile, the adjusted reported profit target excluding time-lag effects was left unchanged at JPY 210.0 billion.

CHINA:

China’s Five Year Plan emphasizes renewables growth and grid investments

On October 25, China’s 4th Plenum concluded in Beijing with a focus on the 15th Five Year Plan for 2026-2030 and the communique, which was issued after the Plenum, emphasized the importance of investing in the renewable energy ecosystem: “We should develop wind, photovoltaic, hydro, and nuclear energy, promote both local grid integration and outward power transmission…” and “We should make power grids safer and more resilient and enhance the complementarity between them. Sound plans should be drawn up for pumped-storage hydropower, new types of energy storage should be developed, and the construction of smart grids and microgrids should be accelerated.” The expected rapid growth of wind and solar energy should continue to benefit companies such as China Longyuan and China Datang Renewable Power. Increasing power consumption, market reforms and increased efforts to grow and better integrate renewables into a more flexible power network system will necessitate investments to strengthen energy storage systems and the grid. Meanwhile, Chinese firms continue to look for opportunities to grow and diversify outside of China.

Ming Yang builds wind turbines in Europe

Ming Yang, one of China’s largest wind turbine manufacturers, recently announced plans to invest up to £1.5 billion in a factory in Scotland to serve offshore wind projects in the UK and in Europe, with the first phase potentially operational in late 2028. The project awaits approval from the UK government as supply chain, economic, political and national security concerns are weighed. Supply chain constraints, decarbonization targets and economic impact should be tailwinds to get government approval.

China Longyuan: 9M 2025 results underscore wind sector weakness

Longyuan reported a 10% drop in recurring net profit to RMB 5.4 billion in 9M 2025, which reflected well-known industry challenges in the Chinese wind sector. The earning drop was attributed to the decline in wind power tariffs, which outweighed the 5.3% YoY increase in wind power generation to 46.2 billion kWh (wind utilization hours fell by 95 hours YoY to 1,511 hours due to lower wind speeds in 9M 2025, which was offset by an 11% YoY increase in wind generation capacity). Meanwhile, solar power generation increased by 78% YoY to 10.4 billion kWh due to an increase in solar capacity. Longyuan should benefit from a capex push on the back of China’s wind & solar installation target of 3,600 GW by 2035 as the regulatory framework for wind & solar investments should also improve to reach this target.

Huaneng Power surprises with strong thermal power earnings in 9M 2025

Huaneng Power reported a recurring profit of RMB 5.2 billion in 9M 2025 (>80% increase YoY) as thermal earnings beat profit expectations. This came as a positive surprise given the YoY decline in thermal power generation and the recent increase in coal prices. Earnings in the coal-fired segment more than doubled YoY to RMB 6 billion, despite a 7% YoY decline in electricity sold. But the company reported a RMB 365 million impairment charge on its coal-fired plants. Similarly, the solar segment also reported 25% earnings growth to RMB 1.48 billion on a 45% increase in sold solar power. Conversely, the wind segment was weak as the wind profit declined by 38% YoY to RMB 720 million, while the sold electricity from wind increased YoY. Operating cash flow also jumped by 23% to RMB 53 billion on capex of RMB 37 billion 9M 2025.

Private Market Value (PMV) Watch – Deals, Deals and more Private Market Deals

WIND Assets

EDP and Engie sell minority stake in offshore wind farm (22 October 2025): Ocean Winds, which is a 50/50 offshore wind joint venture in France between EDP and Engie, sells a 20.25% stake in the îles d’Yeu & Noirmoutier offshore wind farm to Allianz Global Investors, for an equity value of €0.2 billion (or an EV of €0.567 billion). The 500 MW offshore wind farm benefits from stable long-term revenues based on a 20-year fixed inflation-linked feed-in-tariff (FIT). The wind farm operates 61 Siemens Gamesa 8.2 MW turbines and is in the final construction stages after having already delivered first power in June 2025. After the stake sale, the wind farm will be owned by Ocean Winds (remaining 40% of the 50/50 Engie/EDP jv), Allianz (20.25%), Sumitomo (29.5%), Banque des Territoires (9.75%) and Vendée Energie (0.5%). The private market transaction implies an EV/MW multiple of €5.6 million.

BESS (Battery Energy Storage Systems)

Iberdrola buys battery project in Australia (16 October 2025): Iberdrola acquired a 270 MW/1,080 MWh Tungkillo battery energy storage project in South Australia from RES Australia, adding a new storage development to its country portfolio. The project represents an investment of €275 million, which reflects an EV/MW multiple of €1.02 million/MW and is expected to enter operation in 2028. Iberdrola said the acquisition is part of its plan to invest €1 billion in battery projects in Australia by 2028 as the utility has two other battery projects under construction in Australia: the Smithfield system in New South Wales and the Broadsound project in Queensland, which are both due to come online in 2026 with a total capacity of 250 MW.

Drax acquires battery storage system (30 October 2025): Drax will pay £157.2 million for 260 MW of BESS (Battery Energy Storage System) projects with payments being staged between 2025-2028 according to construction progress. The portfolio contains 260 MW of 2-hour duration batteries across 3 sites in Scotland and England. Construction of all 3 sites is expected to commence in 2026 with the first site operational in 2027. The relatively low implied EV/MW transaction multiple of £0.6 million/MW (€0.69 million/MW) reflects construction, permitting and grid connection risks that are still implicit with these assets.

GAS Assets

Enagas looking to buy a stake in French gas network operator (14 October 2025): Enagas is in talks to buy the 32% stake from Singapore’s sovereign wealth fund in Terega, according to Reuters. The stake could be worth around €600 million with Terega’s valuation, including debt, estimated around €4 billion. Enagas and Terega are partners in the H2Med hydrogen pipeline. Terega’s other shareholders include Snam (40.5% stake) and EDF (18%). As Terega reported an EBITDA of €319.7 million in 2024, the valuation multiple of the private market transaction could imply an EV/EBITDA multiple of around 12.5x.

COMBINED Assets

EDP sells US renewable assets to a private equity fund (6 October 2025): As part of its asset rotation, EDP announced that it sold a 49% common equity stake in a 1,632 MW portfolio in the US to a fund managed by the Ares Infrastructure Opportunities strategy. The portfolio includes 1,030 MW of solar capacity, 402 MW of wind, and 200 MW of storage, distributed across ten assets located in four US markets. Specifically, the portfolio comprises five projects in operation, as well as five projects currently under construction, with commercial operation dates until 2026. All projects have long-term Power Purchase Agreements, with an average remaining contract duration of 18 years. Total estimated EV for 100% of the portfolio amounts to about $2.9 billion (€2.5 billion), which reflects an EV/MW multiple of €1.53 million/MW for the whole asset portfolio.

PE firm I-Squared Capital sells Irish Utility Energia in private transaction (6 October 2025): French investment firm Ardian acquires Energia Group from its existing owner (infrastructure investment firm I Squared Capital) in a deal that values the Dublin-based firm at more than €2.5bn. Energia operates 16 onshore wind farms with an installed capacity of 358 GW and has another 50 GW of onshore wind assets under construction. In addition, Energia operates two CCGT gas power plants with a total capacity of 747 MW. The company also develops a 165 MW data center in Dublin. In financial year ending 31 March 2025, Energia reported an EBITDA of €323.5 million, which reflects an EV/EBITDA multiple of > 7.7x.

ELECTRICITY NETWORK Equipment

GE Vernova (GEV) acquires remaining stake in power equipment joint venture (21 October 2025): GEV will acquire the remaining 50% stake in Prolec GE, its power transformer joint venture with Xignux, for $5.275 billion. Prolec GE is a leading supplier of transformers (among the top 10 largest in the USA) to North American utilities, industrials and data centers, with about $3 billion in revenues and $800 million adjusted EBITDA in 2025. GEV expects the deal to close by mid-2026 and expects that it will deliver $60-120 million in annualized cost synergies by 2028. The acquisition is funded equally with cash and debt and implies an EV/EBITDA multiple of 13.9x (based on 2025 financials) for the whole Prolec company.

European Power Prices and Global Electricity Demand Growth

Although European electricity prices have fallen from the peak levels seen in 2022, they have not returned to the much lower price levels that European consumers (households and industries) were used to until 2020. Instead, European wholesale power prices have rebounded this year and average YTD 2025 wholesale prices have already surpassed the average 2024 prices levels again (see Table 2), which has become a reason for concern for Europe’s energy-intensive manufacturing industries as well as for households and for politicians.

The upward trend in European power prices is primarily driven by rising European gas (and global LNG) prices because gas-fired power generation remains the marginal price setter for electricity prices in Europe. Similar to European electricity prices, average European gas (and global LNG) prices have YTD also surpassed average price levels from 2024 again (see Table 2). Although European gas storage is 83% full at the end of October right before the winter withdrawal season starts, storage levels continue to trend at the lower end of the 5-year inventory range at this time of the year (and 13% below last year’s level at the end of October 2024, see Exhibit 6).

Table 2 Average Electricity, Carbon and Natural Gas Prices

The seven regions/countries listed in Table 3 account for about 80% of the world’s total electricity demand. After most of these regions had already posted a solid increase in electricity consumption in Q2 2025, which led to a 2.8% increase globally in Q2, this trend of rising power demand appears to continue in Q3 as the major consuming countries or regions posted further increases in the months of July and August (see Exhibits 10-17). Electricity demand in the USA, Türkiye, China, Japan and India hit new record levels in July, which explains that global power demand has also reached a new record high in July (see Exhibit 17). Accordingly, Q3 power demand, which is so far already available for Europe and the USA, has continued to increase by 0.7% and by 2.1%, respectively.

Table 3 Quarterly Electricity Demand (TWh)

Gas Storage and LNG Flows

Exhibit 4 US Gas Storage (BCF) Exhibit 5 US LNG Exports (BCF)

Source: US Energy Information Administration Source: US Energy Information Administration

Exhibit 6 EU Gas Storage (% full) Exhibit 7 EU Gas Demand (TWh)

Source: Gas Infrastructure Europe Source: Bruegel

Exhibit 8 EU Gas Imports by Source (BCM) Exhibit 9 EU LNG Imports by Origin

Source: Bruegel Source: Bruegel

Global Electricity Demand Growth (TWh)

Exhibit 10 Europe Electricity Demand Exhibit 11 USA Electricity Demand

Exhibit 12 Türkiye Electricity Demand Exhibit 13 Latin America Demand

Exhibit 14 China Electricity Demand Exhibit 15 Japan Electricity Demand

Exhibit 16 India Electricity Demand Exhibit 17 World Electricity Demand

Source: EMBER

Power Tracker: Changing Fuel Mix and 3 Biggest Sources of Electricity

EUROPE

Exhibit 18 Europe: Biggest Source of Electricity in Each Country

Exhibit 19 Power Generation Exhibit 20 Share of Wind & Solar (%)

Exhibit 21 Share of Gas (%) Exhibit 22 Share of Nuclear (%)

Source: EMBER

USA

Exhibit 23 USA: Biggest Source of Electricity in each State

Exhibit 24 Power Generation Exhibit 25 Share of Gas (%)

Exhibit 26 Share of Wind & Solar (%) Exhibit 27 Share of Nuclear (%)

TÜRKIYE

Exhibit 28 Power Generation Exhibit 29 Share of Coal (%)

Exhibit 30 Share of Wind & Solar (%) Exhibit 31 Share of Gas (%)

INDIA

Exhibit 32 Power Generation Exhibit 33 Share of Coal (%)

Exhibit 34 Share of Wind & Solar (%) Exhibit 35 Share of Hydro (%)

Source: EMBER

CHINA

Exhibit 36 Power Generation Exhibit 37 Share of Coal (%)

Exhibit 38 Share of Wind & Solar (%) Exhibit 39 Share of Hydro (%)

JAPAN

Exhibit 40 Power Generation Exhibit 41 Share of Gas (%)

Exhibit 42 Share of Coal (%) Exhibit 43 Share of Wind & Solar (%)

Source: EMBER

MIDDLE EAST – Energy Mix in Six Gulf Cooperation Council (GCC) Countries

Exhibit 44 Saudi Arabia Power Gen (TWh) Exhibit 45 UAE Power Gen (TWh)

Exhibit 46 Qatar Power Gen (TWh) Exhibit 47 Kuwait Power Gen (TWh)

Exhibit 48 Oman Power Gen (TWh) Exhibit 49 Bahrain Power Gen (TWh)

Table 4 Performance and Valuation Comps Table

191 MASON STREET, GREENWICH, CT 06830 Gabelli Funds TEL (914) 921-5100

This whitepaper was prepared by Jens Zimmermann, CFA, by Ashish Sinah, CFA, and by Chong-Min Kang. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The Research Analysts’ views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual Research Analysts’ as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Research Analyst or of the Firm as a whole.

As of June 30, 2025, affiliates of GAMCO Investors, Inc. beneficially owned less than 1% of all companies mentioned.

Funds investing in a single sector, such as utilities, may be subject to more volatility than funds that invest more broadly. The utilities industry can be significantly affected by government regulation, financing difficulties, supply or demand of services or fuel and natural resources conservation. The value of utility stocks changes as long-term interest rates change

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund before

investing. The prospectus, which contains more complete information about this and other matters, should be

read carefully before investing. To obtain a prospectus, please call 800 GABELLI or visit www.gabelli.com

Returns represent past performance and do not guarantee future results. Current performance may be lower or

higher than the performance data quoted. Investment return and principal value will fluctuate so, upon

redemption, shares may be worth more or less than their original cost. To obtain the most recent month end

performance information and a prospectus, please call 800-GABELLI or visit www.gabelli.com

Distributed by G.distributors, LLC., a registered broker dealer and member of FINRA

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com

Gabelli Funds, LLC is a registered investment adviser with the Securities and Exchange Commission and is

a wholly owned subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).