Introduction

Equity markets remain dominated by a handful of mega-cap technology stocks, driving record concentration within major indices and leaving large segments of the market overlooked. While this dynamic has rewarded passive investors, it has also created meaningful valuation dislocations – particularly across small-cap stocks.

With small caps trading at historic discounts, an easing monetary backdrop, and an accommodative fiscal policy ahead, we see a compelling setup for small caps to outperform large caps in the next market cycle. In this write-up, we outline our five reasons to own small caps today, highlighting why this underappreciated segment offers attractive opportunities for our active, research-driven Private Market Value (PMV) with a Catalyst™ approach.

Reason #1: Concentration Could Prompt Diversification

The Magnificent 7 Could be a Larger Than Expected Position in Your Portfolio

As shown in the first chart, the top five and ten constituents of the S&P 500 represent approximately 29% and 40% of the index’s total weight, respectively. The top five companies, Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG/L), and Amazon (AMZN) have a combined market capitalization of $18.7 trillion, growing $8.3 trillion since the start of 2024. This remarkable appreciation, fueled by advances in cloud computing and AI, low interest rates, and sustained flows into passive investment vehicles, has resulted in historically elevated market concentration.

While the dominance of large-cap stocks and their prevalence in major indices like the S&P 500 are well known, it’s equally important to acknowledge the critical role of small-cap companies. Typically defined as those with a market capitalization under $2 billion, small-cap stocks contribute meaningfully to both domestic and global innovation and economic growth, while also offering valuable portfolio diversification despite their modest scale.

Source: Bloomberg

Reason #2: Small is Cheap

Profitable Small-Cap’s Current Valuation Offer Opportunity in an Accelerating M&A Environment

As of October 31st, the S&P 500 and Russell 2000 trade at 24.3x and 17.7x forward P/E*, respectively – a spread of roughly 6.6x. While both indices trade above 10-year averages, it is important to note valuations on a relative basis. When comparing current valuations over the last ten years, the S&P 500 is currently trading in the 98th percentile versus 67th percentile for the Russell 2000. The spread between both indices also sits at a historically high level, now ranking in the 99th percentile.

This current dispersion also highlights opportunity within the profitable small-cap universe, as acquirers increasingly seek accretive deals at compelling entry points. With healthy corporate balance sheets and private equity firms sitting on record levels of dry powder, lower relative valuations create a favorable setup for renewed deal activity. Profitable small-cap companies trading at discounted multiples are well-positioned to attract both strategic and financial buyers, offering investors potential upside as M&A momentum accelerates.

*Forward P/E represents current price to 2026 estimated earnings excluding companies with negative earnings

Source: Bloomberg

Reason #3: Declining Interest Rates & Debt

With the Federal Reserve Cutting Rates, Floating Rate Debt Exposure Can Provide an Earnings Boost for Small Caps

With the most recent fed meeting on October 29th resulting in an additional 25 bps cut, the Federal Funds Rate (FFR) 150 bps lower since the start of the cutting cycle in August 2024. While a reduction in borrowing costs benefits companies either looking to issue new debt or refinance existing debt, small-cap companies have a unique nuance we view as beneficial in the current monetary environment.

As indicated in the chart, floating versus fixed debt is disproportionately higher when comparing the Russell 2000 (small cap) and the S&P 500 (large cap). This has made these companies exposed to greater interest expenses during the fed’s “higher for longer” monetary policy. With a soft-landing scenario where we see additional rate cuts complimented by healthy consumer demand and easing inflation, lower interest expenses will add an incremental boost to smaller companies’ earnings.

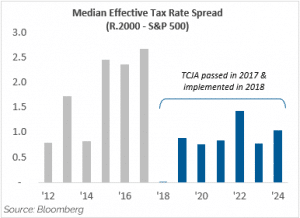

Reason #4: Tax Reform Tailwinds: TCJA & OBBBA Support Small Cap Outperformance

Recent and Ongoing Tax Policy Changes Favor Smaller, Domestic-Focused Businesses

Implemented in 2018, the Trump administration’s Tax Cuts & Jobs Act (TCJA) reduced the corporate tax rate from 35% to 21%, addressing concerns that U.S. rates were among the highest globally. The law also reformed the territorial tax system, encouraging repatriation of foreign earnings and greater domestic investment. While smaller, domestically focused firms continued to face higher effective tax rates than larger multinationals, the TCJA narrowed this gap meaningfully.

With the One Big Beautiful Bill Act (OBBBA), passed into law in July 2025, the government introduced the largest set of tax cuts for both individuals and businesses since the TCJA in 2017. The major provisions of the bill include 100% bonus depreciation, domestic R&D expensing, and a step up in interest expense deductions. As these pro domestic business policies are implemented through 2026 and beyond, we expect small-cap companies to disproportionately benefit over the longer term.

Reason #5: Under Covered & Unloved

Lack of Wall Street Coverage Offers Great Opportunities to Buy Mispriced Stocks

With the sell-side research industry shrinking over the past decade, analyst coverage has become increasingly scarce in the small cap space. This lack of Wall Street attention creates opportunities for active managers to uncover hidden gems that may be mispriced by the market. As shown in the chart, more than 50% of the companies in the Russell 2000 Index are covered by fewer than five analysts. In contrast, 99% of the names in the S&P 500 Index are covered by more than five analysts, with nearly half followed by 25 or more.

With over 1,000 companies having fewer than five sell-side analysts and even more outside the benchmark, the small-cap investment universe remains fertile ground for discovery. These stocks may be overlooked and “unloved”, but more importantly, they could be significantly undervalued.

Index Constituents – Analyst Coverage

S&P 500 vs. Russell 2000

Source: Factset

This whitepaper was prepared by Cameron Acito. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The author’s views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual author as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Portfolio Managers or of the Firm as a whole.

As of June 30, 2025, affiliates of GAMCO Investors, Inc. beneficially owned less than 1% of all companies mentioned.

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

Investors should consider the investment objectives, risks, sales charges and expense of the fund carefully before investing.

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com