What you need to know

After Utilities had outperformed the broader market (MSCI World index) with strong share price performances in the first half of 2025, Utilities stocks have so far not been able to maintain the strong positive momentum in Q3 2025. While the MSCI World benchmark index extended the recovery rally from Q2 into Q3, the MSCI World Utilities index trailed the broader market as European and US Utilities posted small losses in August. Only the S&P Global Clean Energy Index gained and extended in August its share price recovery from heavy losses in previous years. While Utilities stocks in Europe and in the US are still posting solid double-digit returns YTD in 2025 (of 14.4% and 10.3%, respectively), the YTD outperformance of the MSCI World Utilities and of the MSCI Europe Utilities indices has now narrowed relative to the MSCI World benchmark index (see Table 1).

Table 1 Index Performances

The strong YTD performance of European Utilities is reflected in similar share price gains of our equal-weighted European Utilities sub-sector indices, with “Power Generation”, “Integrated Utilities” and “Electricity Networks” all posting double digit YTD gains of 17.9%, 16.8% and 16.3%, respectively. Solid Q2 results along with earnings growth prospects from renewable power demand and from growing capex for grid investments in Europe have supported strong share price performances across all Utilities Sub-Sectors in Europe. Similarly, wind and solar equipment companies continue to benefit from the positive backdrop of growing wind and solar deployments, which is reflected in solid YTD share price gains of 30% for our “Wind Energy Equipment” and “Solar Energy Equipment” indices (see Table 1).

Exhibit 1 Rebased 1-Year Index Performances

Source: Thomson One (as of 29 August 2025)

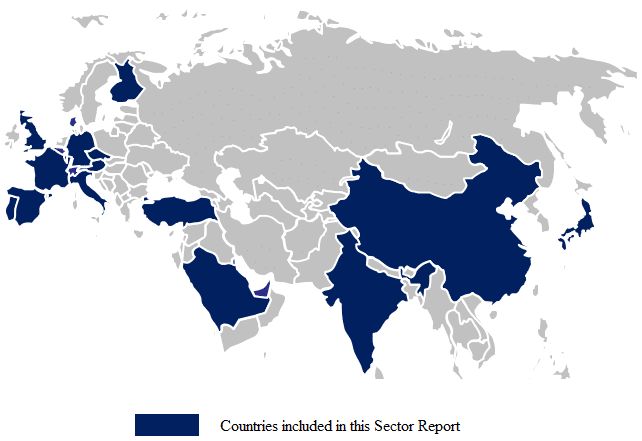

Monthly Focus: Wind & Solar Growth Momentum shifting from the USA to Europe?

For energy import-dependent Europe, an accelerated build out of home-grown renewable energy had become a matter of national energy security when Russian pipeline gas stopped flowing with the start of the Ukraine War in 2022. Accordingly, the European Union’s REPowerEU Plan had raised the 2030 target for renewable energy in power generation to 45%, from 40% previously. To reach this target, the EU plans to install 600 GW of solar capacity by 2030 (which implies a doubling from the 304 GW installed capacity in 2024) and intends to reach 480 GW of wind capacity by 2030 (which also implies that wind capacity will have to double from 230 GW in 2024).

But the US Inflation Reduction Act (IRA) with generous Investment Tax Credits (ITC, 30% of project cost) and Production Tax Credits (PTC, 3.0 cents/kwh for 10 years) for solar and wind projects had put Europe’s renewable growth targets into jeopardy as green energy investments were diverted from Europe to the USA. Now the “One Big Beautiful Bill” (OBBB) upends the IRA by terminating the ITC and PTC tax credits for wind and solar projects, if they are placed into service after December 31, 2027. Only projects that begin construction until July 4, 2026, are safe-harbored and can still receive the full ITC and PTC if completed within four years (through mid-2030).

On balance, the final outcome of the OBBB was better-than-feared because most wind and solar projects in the current backlogs of US and European renewable energy utilities can still be completed with full ITC and IPC benefits. However, the risk remains that the Trump Administration uses its executive powers to strike down projects that have already received permits and all approvals, even for project developments that are well under way. In August, Orsted received a stop-work order for its 80% complete Revolution Wind project and the Interior Department considers cancelling the federal approval for the Maryland Offshore Wind Project.

This project execution risk is not just limited to offshore wind projects in the USA but could also affect onshore wind projects because the government has revoked the approval for a wind farm in Idaho based on legal deficiencies in the issuance of the approval for the project. Although the USA remains an import growth market for the renewable energy sector, it is less likely that European renewable utilities continue to invest at the same level in new US wind and solar developments from 2028 onwards, when the ITC and PTC expire and US political risks remain high.

Not surprisingly, offshore wind developers were the first to cancel and abandon future investment plans in the USA. RWE, which holds three offshore leases, said it had halted work on its US projects given the political developments and Japan’s Mitsubishi has also abandoned plans for the development of floating wind farms off the coast of Maine. Similarly, the oil majors TotalEnergies and Shell have also dropped investment plans for US offshore wind farms.

But the re-allocation of capex away from the USA is not just limited to offshore wind. European renewable utilities with the highest exposure to the US market (EDP, RWE and Engie) have all said that they are re-evaluating their medium-term capital allocation plans for wind and solar deployments to the USA. Especially renewable utilities in Europe now have an incentive to re-allocate capex from the USA to Europe and to increase their exposure to the home market at a time when European governments are prioritizing policy reforms to support the renewable energy sector’s growth in an effort to achieve decarbonization targets and to reduce the reliance on Russian gas (as 11% of Europe’s gas imports and 16% of Europe’s LNG imports still come from Russia, see Exhibits 7 and 8).

The latest investment data from Bloomberg New Energy Finance for the first half of this year seem to confirm the view that wind and solar investments may be shifting from the USA to Europe. Overall, US investments in solar and wind projects came to $35 billion in H1 2025, which was down 36% from H2 2024. In comparison, wind and solar investments in the EU reached $75 billion in H1 2025, which reflected a 63% increase from H2 2024. The investment growth was particularly strong for wind energy, which reached a record level of $40 billion in the EU and a further $5.1 billion in the UK in the first half of 2025.

This capital re-allocation from the USA towards Europe is also partially reflected in recent wind and solar capacity additions. Based on data from Ember, Europe had already added more wind and solar capacity than the USA during the first half of the previous three years, when Europe added about 25 GW during H1 of every year, while the USA added only18 GW in H1 2023 as well as 23 GW in H1 2024 and in H1 2025 (see Exhibit 2).

However, relative to the already installed wind and solar capacity, the USA added new wind and solar capacity at a slightly higher rate than Europe over the past two years. For example, the USA added 23 GW of wind and solar capacity in H1 2025, which reflected a 6.1% increase from its installed capacity of 381 GW that was already in place in 2024. In comparison, Europe increased its solar and wind capacity only by 5.3% in H1 2025, by adding 25 GW of new wind and solar projects to the existing 474 GW capacity at the end of 2024.

But these capacity additions in Europe and in the USA pale in comparison to the wind and solar ramp-up in China as the country tries to reach the targeted 20% share of non-fossil fuels in the country’s energy mix by 2025 (see our comment under “Power Points”). China increased wind and solar capacity by 19% in H1 2025 (added 308 GW) to its installed wind and solar capacity base of 1,585 GW that was already in place at the end of 2024.

Exhibit 2 Wind & Solar H1 Capacity Additions, in absolute GW and as (%) of previous year

Source: Ember

Power Points

Work-stop orders derail offshore wind developments in the USA

The US offshore wind industry is unusually exposed to political risk because projects planned in federal waters are controlled by the President and his executive branch. About 8 GW of offshore wind power capacity has been threatened or blocked by the Trump Administration, which is more than half of the 14 GW of offshore wind projects that were approved by the Biden Administration. After Orsted and Blackrock had received a stop-work order for their 80% completed Revolution Wind project off the coast of Rhode Island and Connecticut at the end of August, the Interior Department also intends to vacate and re-evaluate its approval of the Maryland Offshore Wind Project (owned by Apollo Global Management and Italian Toto Holding).

At the beginning of September, the Trump Administration said it plans to block Iberdrola’s New England 1 & 2 projects offshore Massachusetts. If these projects should lose their permits, the impact would be small because both were already postponed without having received new Power Purchase Agreements. However, much more negative for Iberdrola would be the cancellation of its 800 MW Vineyard Wind project (which Iberdrola owns with Copenhagen Infrastructure Partners), which is expected to be completed over the next months and to come online by the end of 2025. Considering that the original permit for Vineyard Wind was granted under the first Trump Administration in December 2018, it appears less likely that this project will be stopped so close to completion.

Unprecedented capex growth for European power grids drives capital increases

Considering the required growth in electricity networks across Europe, which will be needed to accommodate a rising share of intermittent wind and solar energy in Europe’s power grid, several European regulated electricity network operators have projected strong capex growth that was partially financed with a capital increase. Along with its H1 2025 results, Iberdrola announced a €5 billion rights issue in July to finance a projected 75% increase of its grid capex to €55 billion in 2026-31 (which compares to the €31 billion the company has spent in 2020-25). This should allow Iberdrola’s regulated asset base (RAB) to grow from an expected €51 billion in 2025 to above €90 billion by 2031. Other European electricity network operators see similar long-term investment opportunities to grow their regulated asset base in their grid network business and have also issued equity to finance this growth: Elia Group (Belgium) raised EUR 2.2 billion in March and National Grid (UK) raised GBP 7 billion in May.

In contrast, while German utility E.ON also expects significant growth potential for its German power network business, the company said it has enough balance sheet headroom to finance this growth without a capital increase. E.ON plans to raise its annual capex in its “Energy Networks” segment across Europe by more than €1.0 billion annually to €7.2 billion per annum from 2025 until 2028 (which reflects total capex of about €29 billion for electricity and gas networks in 2025-28). As the majority of these investments will be deployed in Germany, E.ON is projecting that its German electricity network RAB will grow at a CAGR of 10% from 2024 until 2028, or by almost 50% from €23 billion in 2024 to €34 billion in 2028. However, in contrast to its European network peers mentioned above, E.ON believes it can finance the targeted growth of its regulated asset base with its own balance sheet.

Orsted plans a highly dilutive rights issue in September/October 2025

Along with better-than-expected Q2 2025 results, Orsted announced a Danish krona (dkr) 60 billion (about $9.0 billion) rights issue on August 11, 2025. The dkr 60 billion equity raise represented 66% of Orsted’s closing market cap on the day of the announcement (when the stock plunged 30% on August 11) and, depending on the issue price, which investors will not know until September, the rights issue will most likely increase the share count by 50-70%. The reason for the capital raise is the company’s inability to divest a 50% stake in its US offshore wind project, Sunrise Wind, on adequate terms. The dkr 60 billion rights issue will cover dkr 40 billion of the previously expected divestment proceeds plus an additional dkr 20 billion to further strengthen the balance sheet over the next years.

In a vote of confident, the Danish State, which owns as a majority shareholder a 50.1% stake in Orsted, confirmed its support and intention to subscribe to a pro-rata share of the new offering. In addition, Orsted’s second largest shareholder Equinor, which owns 10% in Orsted, has also announced to participate in the rights issue. Taken together, this reflects shareholder commitments of 60.1% and reduces the overhang risk on the rights issue.

Germany plans to lower electricity prices

The Germany government has proposed new policy measures to bring down electricity costs, but industry associations believe that the new plans do not go far enough. The German Finance and Energy Ministers said in a joint statement that the draft law plans to reduce electricity taxes by about €26 billion over four years. While the new government’s coalition agreement had pledged earlier this year to lower electricity taxes for all consumers, the new plan intends to cut them only for the manufacturing, farming and forestry sectors. A second proposed measure will reduce a separate levy paid by all consumers to finance the urgently needed electricity network investments. The German government estimates that this will save an average household about €100 per year, on top of €50 per year from the scrapping of a separate tax on natural gas. However, the German Industrial Labor Union IG Metall believes that these measures were an “important signal” but that Germany still needed “internationally competitive electricity prices”. Similarly, Germany’s VDA Automakers’ Federation said the plans “do not sufficiently address the problem”, pointing out that electricity costs in Germany were still three times as high as in China or in the USA.

To put this discussion into context, Germany’s wholesale electricity prices have again increased by 14% YTD in 2025, which is very much in line with the 13% YTD increase of Europe’s natural gas price (as electricity prices are closely correlated with gas prices in Europe). At an average price of €89/MWh in 2025, Germany’s electricity price is now three times higher than the average price was at €30/MWh in 2020, the year before Europe’s electricity prices jumped along with European gas prices in the run-up to the Ukraine war (see Table 2). In addition, Germany has one of the highest electricity prices compared to other European countries along with Italy (average of €118/MWh YTD in 2025) and the UK (€100/MWh).

United Kingdom: Independent Commission proposes reshuffling of the UK Water Sector

In late July, the Cunliffe Review Final Report came out, which recommended that the UK should replace the Water Services Regulation Authority (Ofwat), the Drinking Water Inspectorate (DWI) and other agencies with a single water regulator for England and Wales. Other proposed reforms include regional water authorities, a common WACC across regulated sectors, narrowing the Outcome Delivery Incentives (ODI), an increase in base capex, smart metering, a social tariff and tighter governance. The Review Report proposes these measures as a positive step to create a “more resilient and lower risk” water sector that will help to restore public trust in the UK water industry. The reforms are targeted for the next five-year regulatory cycle AMP 9 (Asset Management Period 9), which starts in April 2030 when the current regulatory cycle AMP 8 ends (which runs from April 2025 to March 2030).

Severn Trent provided a 1Q FY2026 (fiscal year ends 31 March 2026) trading update, which indicated a performance that is in-line with its guidance of achieving at least £25 million (post tax) in ODIs with growth expected later over AMP 8. Water leakage is a focus area for Severn Trent and the company indicated a 65% reduction in water spills for Jan-Jun 2025. The company has also spent £360 million of its £1.7-£1.9 billion capex target for FY2026. The company has guided to doubling EPS over the next 3 years during FY25-28 from 112.1 pence in FY25 on the back of regulated revenue growth, ODI outperformance, cost management and financing outperformance. During the current regulatory period AMP 8 (which runs from April 2025 until March 2030), the company targets 59% nominal growth in its regulatory capital value (RCV) compared to the average of 28%, which the company delivered during the previous regulatory cycles AMP 5-7. After the £1 billion equity capital raise in FY24, Severn Trent is now fully equity funded for AMP 8.

China’s decarbonization targets require rapid change in fuel mix

China’s 14th Five Year Plan (2021-2025) has targeted peak carbon emissions before 2030 and carbon neutrality by 2060. The current Five Year Plan had originally aimed for the share of non-fossil fuel to comprise 20% of China’s energy mix, which the country is expected to exceed by the end of this year as YTD in 2025, renewable energy already accounts for 25% of China’s power generation and hydro power generates 11% of its electricity (see Exhibit 27). China has also targeted an 18% reduction of the amount of CO2 produced per unit of GDP over the next five years, which reflects the same target as in the last Five-Year Plan.

Considering that China wants its carbon emissions to peak in 2030, the upcoming next 15th Five Year Plan (2026-2030) is expected to set the next targets for carbon emissions, renewable energy and energy consumption accordingly, with the focus shifting from reducing energy consumption to reducing carbon emissions. In-line with an expected further increase in non-fossil fuel power generation along with the goal to increase the country’s energy security, China began the construction of its $170 billion dam project in Tibet in July, with an estimated annual power generation capacity of 300 billion kilowatt-hours and an expected operational start in the early-to-mid 2030s.

Chinese Offshore Wind delays hit Chinese cable company

Ongoing project delays for China’s offshore wind projects have weighed on the financial results of Chinese offshore cable manufacturer Ningbo Orient Wire & Cables, which reported a strong drop in quarterly earnings that also missed rather cautious consensus expectations. Ningbo reported a 47% YoY drop in Q2 2025 profits to Rmb 188 million, which missed the consensus estimate by 70% after the market had already expected earnings pressure from delays in Chinese offshore wind projects. Similarly, the drop in profit margins was also related to project delays because higher margin products are usually part of later stages during the project execution, which could not be completed due to project delays.

Thus, Ningbo’s earnings could continue to suffer from offshore wind project delays in the short-term, while the company’s earnings prospects remain positive in the long-term given the company’s strong order backlog. Ningbo’s disappointing financial result on the back of project delays is also reflected in a relatively weak share price performance (+4% YTD in 2025) when compared to its peers in the wind energy equipment sector (see Table 4 in the end).

Japanese Utilities started a late catch-up in Q3 2025

After lackluster share price performances in 2024 and in the first half of 2025, the share prices of Japanese utilities have started to turn the corner with a solid rebound in Q3. While our “Japan Integrated Utilities” index had declined by 6% in the first half of 2025 on the heels of the full year 2024/25 results, the share prices of most Japanese electric utilities have soared since the beginning of July when companies finished reporting Q1 2025/26 earnings. Accordingly, our “Japan Integrated Utilities” index rebounded by 23% QTD in Q3, which puts the YTD performance at 16.1% in 2025, even slightly ahead of the 14.4% of the MSCI Europe Utilities benchmark index (see Table 1).

Three factors appear to have triggered the sudden surge in investor sentiment. First, several Japanese utilities have reported better-than-expected profits in the most recent Q1 2025/26 results season as lower commodity prices have reduced power generation costs for thermal power generation and a larger share of hydropower generation has also reduced generation costs in relative terms. Second, investors like that Japan is also moving towards a nuclear renaissance and several companies (such Hokkaido and Kansai) plan to increase the share of nuclear or add nuclear energy to their fuel mix again (which started to rebound in Japan, but currently makes up only 10% in Japan’s total energy mix, see Exhibit 39). Third, investors also see upside potential for future energy demand growth in Japan from AI data centers.

Saudi Arabia: ACWA Power targets renewable energy push with strong wind and solar investment growth

Saudi Utilities company ACWA Power leads a consortium to invest €8.3 billion to build 15 GW of solar and wind capacity in Saudi Arabia. ACWA Power and Aramco Power (part of Saudi Aramco) have signed Power Purchase Agreements with the state-owned Utility company to build five solar and two wind projects across Saudi Arabia. At the end of 2024, Saudi Arabia had 4.7 GW of installed solar capacity and targets to increase the country’s solar and wind capacity to 130 GW by 2030.

ACWA’s investment in renewable energy is part of the country’s plan to diversify the Saudi economy away from its dependence on hydrocarbon exports. In addition, Saudi Arabia plans to generate 50% of its electricity from renewable energy sources by 2030 as the country pursues the goal to cut carbon emissions to net zero by 2060. To put these renewable energy growth target into perspective, at the end of 2024, Saudi Arabi had an installed wind and solar capacity of only 4.7 GW, which accounted for 5% of the country’s total installed power generation capacity of 102 GW (of which 69 GW was gas-fired power plants and 28 GW was oil-fired power generation).

European Power Prices and Global Electricity Demand Growth

Supply shortages or even gas rationing could be avoided in Europe during 2022 because cheap Russian pipeline gas was quickly replaced with more expensive LNG imports (see Exhibit 7). As a result, European gas prices started to decline in 2023 and in 2024 but stayed at elevated levels compared to pre-Ukraine war levels in 2020 (see lower section of Table 2). As European electricity prices are highly dependent on European gas prices, wholesale electricity prices have also followed gas and LNG prices higher in 2025. At current levels, European electricity prices are more than twice as high as power prices were before the Ukraine war started, which puts many energy-intensive industries in Europe at a competitive disadvantage relative to the USA and China.

Table 2 Average Electricity, Carbon and Natural Gas Prices

Together the seven regions/countries listed in Table 3 accounted for about 80% of the world’s total electricity demand in Q2 2025. The electrification of the power sector and of hard-to-decarbonize industrial and transport industries continue to drive demand for electricity in Europe, which consumed 1,105 TWh of electricity in Q2 2025, or about 15% of global electricity demand. In addition, US electricity demand is supported by growing power demand from data centers, which is projected to drive US electricity consumption in coming years.

In contrast, GDP growth in developing economies, such as China and India, is still much more electricity-intensive than in developed OECD economies, which explains their solid quarterly growth rates for power demand.

Table 3 Quarterly Electricity Demand

Gas Storage and LNG Flows

Exhibit 3: US Gas Storage (BCF) Exhibit 4: US LNG Exports (BCF)

Source: US Energy Information Administration Source: US Energy Information Administration

Exhibit 5: EU Gas Storage (% full) Exhibit 6: EU Gas Demand (TWh)

Source: Gas Infrastructure Europe Source: Bruegel

Exhibit 7: EU Gas Imports by Source (BCM) Exhibit 8: EU LNG Imports by Origin

Source: Bruegel Source: Bruegel

Global Electricity Demand Growth (TWh)

Exhibit 9: Europe Electricity Demand Exhibit 10: USA Electricity Demand

Exhibit 11: Türkiye Electricity Demand Exhibit 12: Latin America Demand

Exhibit 13: China Electricity Demand Exhibit 14: Japan Electricity Demand

Exhibit 15: India Electricity Demand Exhibit 16: World Electricity Demand

Global Power Tracker: Changing Fuel Mix and 3 Biggest Sources of Electricity

EUROPE

Exhibit 17: Europe: Biggest Source of Electricity in each Country

EUROPE

Exhibit 18: Power Generation Exhibit 19: Share of Wind & Solar (%)

Exhibit 20: Share of Gas (%) Exhibit 21: Share of Nuclear (%)

USA

Exhibit 22: USA: Biggest Source of Electricity in each State

USA

Exhibit 23: Power Generation Exhibit 24: Share of Gas (%)

Exhibit 25: Share of Wind & Solar (%) Exhibit 26: Share of Nuclear (%)

Source: EMBER

TÜRKIYE

Exhibit 27: Power Generation Exhibit 28: Share of Coal (%)

Exhibit 29: Share of Wind & Solar (%) Exhibit 30: Share of Gas (%)

INDIA

Exhibit 31: Power Generation Exhibit 32: Share of Coal (%)

Exhibit 33: Share of Wind & Solar (%) Exhibit 34: Share of Hydro (%)

Source: EMBER

CHINA

Exhibit 35: Power Generation Exhibit 36: Share of Coal (%)

Exhibit 37: Share of Wind & Solar (%) Exhibit 38: Share of Hydro (%)

JAPAN

Exhibit 39: Power Generation Exhibit 40: Share of Gas (%)

Exhibit 41: Share of Coal (%) Exhibit 42: Share of Wind & Solar (%)

Source: EMBER

Table 4 Performance and Valuation Comps Table

191 MASON STREET, GREENWICH, CT 06830 Gabelli Funds TEL (914) 921-5100

This whitepaper was prepared by Jens Zimmermann, CFA, by Ashish Sinah, CFA, and by Chong-Min Kang. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The Research Analysts’ views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual Research Analysts’ as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Research Analyst or of the Firm as a whole.

As of June 30, 2025, affiliates of GAMCO Investors, Inc. beneficially owned less than 1% of all companies mentioned.

Funds investing in a single sector, such as utilities, may be subject to more volatility than funds that invest more broadly. The utilities industry can be significantly affected by government regulation, financing difficulties, supply or demand of services or fuel and natural resources conservation. The value of utility stocks changes as long-term interest rates change.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. The prospectus, which contains more complete information about this and other matters, should be read carefully before investing. To obtain a prospectus, please call 800 GABELLI or visit www.gabelli.com

Returns represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so, upon redemption, shares may be worth more or less than their original cost. To obtain the most recent month end performance information and a prospectus, please call 800-GABELLI or visit www.gabelli.com

Distributed by G.distributors, LLC., a registered broker dealer and member of FINRA.

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com

Gabelli Funds, LLC is a registered investment adviser with the Securities and Exchange Commission and is

a wholly owned subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).