Another year, another year of mega-cap “tech” dominance.2 In this update to our 2020 note “The Nation State Companies”, we ask what explains the outsized performance of a handful of market leaders and whether the conditions exist for that to continue.

As any consumer of financial media knows, the market darlings of the last decade have evolved from the “FANG” to “MAMAA” to the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, NVDIA, Meta and Tesla).

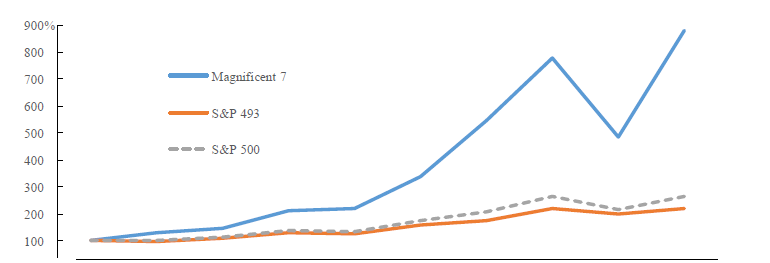

As of December 12, the M7 possessed an aggregate market capitalization of $10.7 trillion (currently 28% of the S&P 500) and accounted for 15 points of the S&P 500’s 23% YTD 2023 total return (i.e. leaving the “S&P 493” collectively up only 8%). In addition, 44% of stocks in the S&P 500 remain down for the year. Echoing a comment from our 2020 note, the seven largest companies in the S&P don’t just dominate the market, they are the market.

As a practical matter, buyers of market index products who think they are receiving cheap diversification are in fact concentrating in a handful of companies with similar value drivers. That may be positive – it has been the winning strategy for many years – but as illustrated in 2022, it could add risk in several scenarios. We believe there is increasing value in owning something different, whether smaller capitalization stocks or a more value-oriented portfolio.

MAG SEVEN TO THE RESCUE

Just because a pattern is unusual does not make it unfounded. The years since the Great Financial Crisis have been remarkable in many ways. During this period, a cluster of super companies flourished in the fertile soil of: (a) historically low interest rates; (b) leaps in computing power and mobility; (c) lax regulatory oversight; and (d) changes in consumer behavior solidified by the pandemic. Coming into 2023, the M7 checked many boxes for investors:

- Cash machines protected by fortress balance sheets. In theory, “growth” companies should underperform in a rising rate environment because their cash flows are weighted to the future (i.e. longer duration). The Mag Seven are no ordinary growth companies however. They enjoy massive, cyclically advantaged profits today and (in aggregate) net cash balances that both insulate them from increasing funding costs and allow them to invest through the cycle. In a world of increasing danger and deficits, the M7 are safe sovereigns unto themselves.

- Multiple secular tailwinds. While a discussion of winners and losers from Artificial Intelligence is beyond the scope of this note, we believe it will indeed transform the world. Lacking investment candidates, the Mag Seven have been anointed winners. This comes in addition to certain M7 members drafting off other popular themes including cloud computing, mobility and direct-to-consumer services.

- Reasonable valuations. Hindsight is surely 20/20, but after a disappointing 2022, the valuation of the M7 as a group was more than reasonable, trading at near parity to the Other 493.

THE NEAR FUTURE

Many of the attributes above are as applicable today as one year ago, especially if some combination (however at odds over a longer time frame) of weak economic growth and higher-for-longer rates unfolds. At the same time, we see idiosyncratic risks as more pronounced: (a) bipartisan legislative/regulatory overhang; (b) the law of large numbers limiting growth (particularly regarding ad revenue); (c) technological disruption (see miss-steps around the introduction of Bard and governance at OpenAI). Perhaps most importantly, valuations are less compelling, especially relative to the rest of the market.

Even absent a deterioration in fundamentals, in a soft landing and/or lower interest rate environment, investors are likely to see better value away from the M7.

OUR ROADMAP

While we are not predicting the downfall of the M7, we are suggesting investors look beyond them and even the Other 493. A variety of concerns has constrained smaller capitalization stocks, especially among those characterized as “value”. At this writing, the Russell 2000 (small capitalization) and Russell 2500 (small-mid “SMID” capitalization) indices have risen 6% and 8% to date, respectively. At least three elements could trigger a more durable rotation in investor preferences:

- Historically wide valuation gap. As shown in Exhibit 4, large cap stocks have run away with the market. The capitalization of the entire R2K is about one-quarter that of the M7 and the R2K is only 6% of the S&P 500’s market cap (vs 10% on average). More interestingly, at ~7 turns, the S&P’s premium to the R2K is the highest it has been in over twenty years (Exhibits 5, 6).

We caveat this comparison by noting: (a) looking at averages can be misleading; and (b) there are structural reasons – e.g., more cyclicality, more leverage, less favorable sector composition – for R2K to trade at a discount. However, normalizing for industry composition, the comparison holds.

- Small a big contributor during recoveries. Given their leverage and cyclicality, smaller cap companies tend to perform well early in the economic cycle. We may be early here – the long expected recession has yet to arrive – but for clients with higher risk tolerance, it may not be too early to position for lower interest rates and reinvigorated economic growth.

Alpha for active. We have spent most of this note justifying the outperformance of mega-cap companies. In many ways, it is simpler than that. Investing in the smaller cap realm takes work and a higher tolerance for volatility. The targets are plentiful but usually ill-covered by Wall St., less accessible, and more illiquid.

Why bother when you can put massive amounts of capital to work with minimal career risk in seven stocks? Well, at this stage we think it’s worth the bother.

Our Private Market Value with a Catalyst™ methodology, supported by deep fundamental research on a wide range of companies, suits this environment. We remain disciplined yet adaptable in our approach and long-term with ever-present intensity in our outlook.