Our team hosted the 30th Annual Aerospace & Defense Conference on September 5, 2024 where a number of aerospace & defense suppliers presented their company outlooks and reactions to the current macro environment.

Lieutenant Colonel Tony Bancroft, USMCR joined GAMCO in 2009 as a research analyst covering companies in the aerospace sectors and environmental services, focusing on suppliers to the commercial, military and regional aircraft industry and waste services. He hosts two annual conferences for the firm: the Aerospace & Defense Conference, and the Environmental Services Symposium. Tony graduated from the United States Naval Academy with a B.S. in Systems Engineering and an M.B.A. in Finance and Economics from Columbia Business School. Previously, Tony served in the United States Marine Corps as an F/A-18 pilot.

Michael Burgio is a research analyst and covers the Aerospace & Defense and Environmental Services sectors. He joined GAMCO Investors in 2022 after graduating from Boston College, where he earned a B.S. in Finance at the Carroll School of Management.

Introduction

At our 30th Annual Aerospace & Defense Conference, the commercial aerospace presenters reaffirmed our view that the commercial aerospace market will return to a healthy state over the long-term. The International Air Transport Association (IATA) indicates world air travel has grown at a 5% CAGR since 1980 (Exhibit 1) and is expected to grow almost 4% annually through 2041. The expectation for a return to growth is driving long term demand for repair and overhaul services and replacement parts, albeit potentially in a new normal where airlines use more salvaged parts from retired aircraft.

China remains a large part of the of the commercial aviation growth story. The country alone accounts for about 20% or 8,830 of the 43,975 global commercial deliveries expected over the next 20 years, more than any region except for North America (23%) and Europe (21%). Boeing has frequently noted China as a substantial market for commercial aircraft. China has 119 737 MAX orders and is estimated to account for roughly half of the almost 1,300 Unidentified/Other Leasing Companies or approximately 18% of the 737 MAX backlog.

The industry continues to believe the fundamentals that have driven air travel for the past five decades and doubled air traffic over the past two decades remain intact. Narrow body aircraft will make up approximately 76% of the demand, or 43,975 deliveries. Wide body airplanes make up 18%, or 8,065 aircraft, and regional jets make up 3.5%, or 1,525 jets. The demand for these airplanes is driven, in part, by global economic growth, and roughly two billion new passengers since 2005, who are willing to spend on travel and tourism. In addition, industry deregulation facilitating low cost carriers’ expansion into new markets and the removal of visa restrictions increase the ease of global travel.

The need for 43,975 passenger transports and freighters over the next 20 years averages out to a little less than 2,200 new airplanes a year. Our combined production forecast for Boeing and Airbus are below this average annual rate (Table 3) suggesting that the commercial aerospace market, post-2024, could remain healthy for some time.

Further, Boeing and Airbus have strong backlogs of 5,596 and 8,024 airplanes, respectively, or about 12 years of current production (Table 4). Despite COVID-19 and the continued Boeing 737 MAX halt on deliveries in China, unprecedented backlog support continued top-line growth for the OEMs and suppliers.

The demand for narrow body aircraft is heavily driven by the replacement of older, less efficient jets with new, fuel-efficient aircraft including the Boeing 737 MAX, Airbus A320neo, A220, Embraer E Jets and the COMAC C919. All the commercial aerospace companies presenting at the conference have content on these re-engined aircraft that should help them drive original equipment and aftermarket growth as the commercial aerospace industry returns to growth.

Strong demand, inflation and the impact of supply chains on Commercial OEM and AM were the key topics at this year’s conference. Most companies expect a continued recovery in global commercial air travel. Increasing flight hours should drive the need for replacement parts, followed by OEM suppliers who have been burning down inventory as Airbus and Boeing produce and deliver more aircraft. Most suppliers have been able to preserve margins with targeted price increases. There is some lag effect with longer-term contracts rolling over and taking effect. The supply chain has slowed growth in almost all aspects on commercial aerospace. While companies have adjusted to the near-term new normal, few are altering long-term strategy.

Defense

In 2024, the U.S. defense budget remained relatively flat at $841 million. This was after a 12.5% increase in 2023 to $852 billion after increasing 7.4% in 2022. Over the last five years the defense budget has grown at 4.9% CAGR. Going forward, the budget is projected to modestly increase at about 1.4% CAGR, as illustrated in Exhibit 3. We believe this presents an appealing investment opportunity, which was reiterated by presenters at the conference. Programs like the JSF, B-21, THAAD, GBSD and GMD are driving growth for many suppliers across the industry.

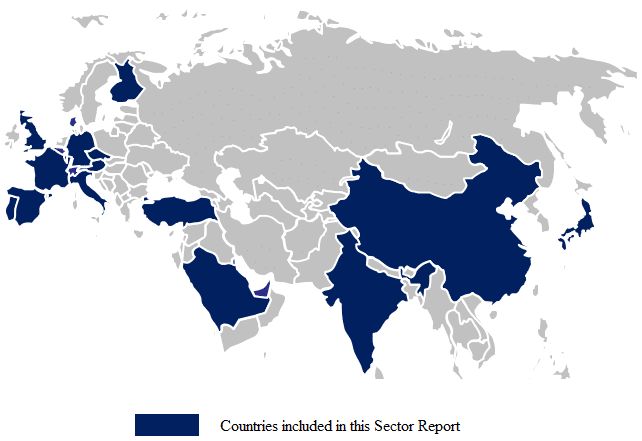

After the invasion of Ukraine by Russia in February 2022, NATO members have said they will increase defense spending in the face of what NATO has described as the most serious security crisis in a generation. APAC NATO Partners as well as other NATO Ally countries have committed to stepping up defense spending. In recent years, most NATO members have begun spending more on defense. (Table 5) We estimate if NATO members ex-US, were to increase defense spending to the 2% target rate, it would an additional $82 billion of defense spending or about 5% growth to the collective NATO defense spending.

However, faster foreign growth combined with sequestration has reduced the United States’ share of global defense spending to ~40% versus 43% in 2010. Meanwhile, over the last decade, contentious countries like China and Russia have increased their investment in defense spending, as illustrated in Table 6. While the U.S. footprint in the Middle East has decreased significantly, geopolitical instability has continued to grow. Tensions persist with Iran and North Korea’s nuclear weapons program remaining opaque. In addition, China has carried out repeated military exercises in the South China Sea near the Paracel Islands and continues to assert claim on Spratly Islands.

AAR Corp (AIR – $66.72 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

AAR Corp. is headquartered in Wood Dale, Illinois and provides products and services to commercial aviation, government, and defense markets worldwide. It operates through Aviation Services and Expeditionary Services segments. The Aviation Services segment engages in lease and sale of new, overhauled and repaired engine and airframe parts and components, as well as aircrafts; and offers customized flight hour component inventory and repair, warranty claim management, and outsourcing programs for engine and airframe parts and components. This segment also provides fleet management and operations of customer-owned aircraft for the U.S. Department of State; customized performance-based supply chain logistics programs, which includes material planning, sourcing, logistics, information and program management, airframe and maintenance planning, and component repair, and overhaul services for U.S. Department of Defense and foreign governments. Further, it offers airframe inspection, maintenance, repair and overhaul, painting services, line maintenance, modifications, structural repairs, avionics service and installation, exterior and interior refurbishment, and engineering services and support; and repair and overhaul components including landing gears, wheels, and brakes for commercial and military aircraft; and operates six airframe maintenance facilities and one landing gear overhaul facility. The Expeditionary Services segment designs, manufactures, and repairs transportation pallets and containers and shelters for military and humanitarian tactical deployment activities, including armories, supply and parts storage, refrigeration systems, tactical operation centers, briefing rooms, laundry and kitchen facilities, water treatment, and sleeping quarters, as well as engages in provision of engineering, design, and system integration services for specialized command and control systems.

Reason For Comment

The following are key takeaways from AAR’s CFO Sean Gillen at our 30th Annual Aerospace & Defense Conference:

- OEM Production Tailwind. The production delays have led to extended lifetime use for aircraft, which has decreased the amount used serviceable material (USM). Looking forward, once the OEMs are able to ramp production rates, more planes should be retired and AAR will be able to source more USM for customers in the aftermarket. Additionally, demand for AAR’s services on mid-to-late life aircraft should remain elevated with the older than average fleet.

- Triumph Support Acquisition. AAR acquired Triumph Support in March for $725m, with a total net purchase price of $645m after adjusting for $80m in present value tax benefits. Currently, AAR expects run-rate cost synergies of $10m annually. The company plans to achieve this by consolidating Triumph’s footprint. From a customer standpoint, the acquisition has been positive. AAR has a more expansive offering with Triumph Product Support, which allows the company to enter the component services business.

- Margin Expansion. Pre-Covid, AAR had an operating margin of around 5.5%. Today, it is close to 9% or 350bps of expansion. Additionally, revenue is still slightly down. The two biggest drivers of margin expansion were in the hangar network and the commercial power by the hour (PBH) business. Previously the hangar network pursued sales growth at the expense of profitability, which is no longer the case. Further, Covid opened the door for AAR to renegotiate its PBH contracts for better profitability. Additionally, the Triumph Product Support business has EBITDA margins in the low 20% range, which have been a tailwind for AAR’s consolidated profit margin.

Albany International (AIN – $85.32 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Albany International Corp., headquartered in Rochester NH, is a global advanced textiles and materials processing company. Its segments include Machine Clothing (MC) and Albany Engineered Composites (AEC). The MC segment supplies consumable permeable and impermeable belts used in the manufacture of paper, paperboard, tissue and towel, pulp, nonwovens, fiber cement and several other industrial applications. It designs, manufactures, and markets paper machine clothing for each section of the paper machine and for every grade of paper. The MC segment also supplies engineered processing belts used in the manufacturing process in the pulp, corrugator, nonwovens, fiber cement, building products, and textile industries. The AEC segment provides engineered, advanced composite structures to customers in the commercial and defense aerospace industries. The AEC segment includes Albany Safran Composites, LLC. AEC also supplies vacuum waste tanks for most Boeing commercial aircraft, as well as the fan case for the GE9X engine.

Reason For Comment

The following are key takeaways from Albany’s CEO Gunnar Kleveland at our 30th Annual Aerospace & Defense Conference:

- Brief Background. Gunnar Kleveland began his tenure at CEO of Albany in 2023. He has robust industry experience and had previously been with Textron for 20 years. Gunnar was attracted to Albany due to its elite technology, particularly as it relates to material science for machine clothing and 3D weaving. The company’s greatest two proficiencies are within 3D weaving and resin transfer molds (RTMs). Further, the future of aircrafts is through composites, with tangible economic benefits from fuel savings. Albany has an excellent solution for this tailwind with its RTM products.

- LEAP Program Update. For context, Albany manufactures composite fan blades for the LEAP engine. The program has been challenged by slow OEM production growth. However, the supply chain is operating well. The program is significant to Albany and represents approximately 1/3 of its aerospace business. If Boeing and Airbus can begin to consistently grow production rates without an issue, it will allow more engines to be delivered, which will help Albany.

- New Program Opportunities. Albany sees a large opportunity in the space market. Currently, space programs are Albany’s fastest growing. Additionally, Albany has been able to take market share by winning new programs. This was a result of the incumbent supplier’s poor execution, which Albany capitalized on. Additionally, Albany is working towards winning several military programs, which should present a large opportunity.

- Machine Clothing. The machine clothing segment has been a high margin and strong cash flow generator for Albany. However, organic growth has been muted. Currently, Albany has ~40% market share in the business, which has allowed the company to increase prices and realize higher margins. Most of the cash flow from this business has been wisely reinvested into the more attractive and faster growing aerospace segment.

Astronics (ATRO – $19.12 – NASDAQ) Aerospace Conference Highlights

COMPANY OVERVIEW

Astronics Corporation, headquartered in East Aurora, NY, is a provider of advanced technologies to the global aerospace, defense, and electronics industries. Its products and services include advanced electrical power generation, distribution and motion systems, lighting and safety systems, avionics products, systems and certification, aircraft structures and automated test systems. The company operates through two segments: Aerospace, and Test Systems. The Aerospace segment designs and manufactures products for the global aerospace industry. Its product lines include lighting and safety systems, electrical power generation, distribution and seat motion systems, aircraft structures, avionics products, systems certification, and other products. The Test Systems segment designs, develops, manufactures and maintains automated test systems that support the aerospace and defense, communications and mass transit industries as well as training and simulation devices for both commercial and military applications.

Reason For Comment

The following are key takeaways from Astronics’ CEO Peter Gundermann and CFO Dave Burney at our 30th Annual Aerospace & Defense Conference:

- Sales Growth Potential. Astronics sees a large opportunity to take market share as older planes are retrofitted with inflight entertainment (IFE) systems. Typically, widebody aircraft have the IFE system, but narrowbodies do not. To be more specific, it is estimated that nearly one-half of narrowbodies need to be retrofitted. There is additional sales upside with 737MAX production, which Astronics has up to 150k in content onboard.

- FLRAA.Textron’s Future Long Range Assault Aircraft program represents Astronics’ largest shipset opportunity, which is estimated to be close to $1m per aircraft. Astronics is going to provide most of the avionics for the FLRAA, which will be highly profitable once the program goes into full production mode. Currently, Astronics anticipates FLRAA related sales of only $50m annually, which should grow significantly in time.

- Margin Upside. Astronics was able to generate upper-teens EBITDA margins, which management thinks is achievable once volumes normalize. In the meantime, Astronics has closed five facilities and has been pricing products in excess of inflation. The key is volume growth, particularly on the 737MAX and 787. Astronics has significant fixed cost so higher volumes generate high incremental profit margins.

- Refinancing. In early July, Astronics refinanced its term loan and revolving credit facility. The objective was to gain more liquidity and free up cash. Additionally, there will be lower principal amortization. Negatively, there will be write-offs of ~$8m in deferred finance charges, but it will be non-cash. This should be a benefit to the income statement as interest expense will decrease.

Bridger Aerospace (BAER – $2.69 – NASDAQ) Aerospace Conference Highlights

COMPANY OVERVIEW

Headquartered in Belgrade, Montana, Bridger Aerospace Group Holdings, Inc. provides aerial wildfire management, relief and suppression, and firefighting services to federal and state government agencies in the United States. It offers fire suppression services, such as direct fire suppression aerial firefighting support services for ground crew to drop large amounts of water quickly and directly on wildfires. The company also provides aerial surveillance services, including fire suppression aircraft over an incident and tactical coordination with the incident commander through its manned and unmanned aircraft.

Reason For Comment

The following are key takeaways from Bridger’s CEO Sam Davis and CFO John Saunders at our 30th Annual Aerospace & Defense Conference:

- Company Background. Founder Tim Sheehy, who is a retired Navy SEAL, identified the importance of aerial surveillance during his time in combat. After leaving the military in 2016, Tim wanted to put this idea to use in civilian applications. The big change occurred when the US Forest Service requested suppression planes to put out wild fires, rather than just identify them. Currently, the company has ~30 aircraft and is the largest provider of aerial wildfire suppression.

- Increasing Wild Fires. Management points to climate change as being the driving factor behind the increased number of wild fires. Additionally, people have moved into areas that were previously uninhabited. This has created more opportunity for fires to start in secluded locations that would not have been the case 30 years ago.

- Competitive Advantages. The company has 6 “Super Scooper” aircraft for fire extinguishment. In total, there are only 8 in all North America. These planes can pick up 1,400 gallons of water in 12 seconds. Additionally, the planes can fly for up to 8 hours. This allows the aircraft to make several trips to pick up water and drop it on fires. Bridger is working with the government to get its planes in quicker, so the company can attack wild fires in infancy before it gets too large and more difficult to extinguish.

- Addressable Market. Today, more than $10 billion per year is spent on fire extinguishment. Additionally, this is a growing market as fires occur more frequently. Bridger has a small, but growing market share, generating $90m. Most markets are sourced by public operators. Further, few operators are privatized and have the same scale as Bridger.

Crane (CR – $153.68 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Crane Company, based in Stamford, CT, is a diversified manufacturer of highly engineered industrial products. Operations are comprised of three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials. Primary end markets include aerospace, defense and space, process industries, non-residential and municipal construction, and a wide range of general industrial end markets.

Reason For Comment

The following are key takeaways from Crane’s CFO Rich Maue, President of A&E John Higgs, and Vice President of Investor Relations Jason Feldman at our 30th Annual Aerospace & Defense Conference:

- Demand Strength. Management was optimistic about near term commercial aerospace demand strength, and pointed out that OEMs are still in ramp mode. This bodes well for Crane, since it has an attractive portfolio of proprietary components spread across broad set of platforms. Additionally, Crane is experiencing continued strength in its defense business. The growth in defense spending is expected to continue, which should be a positive tailwind for Crane over the next decade.

- Post Spin Takeaways. Investor interest has never been higher for Crane than after its spin-off. In total, over $2b in value was created for shareholders. As it stands, management is still operating the same way. There is a constant focus on the portfolio and optimizing assets. Currently, there are no plans to separate the PFT business from the Aerospace & Electronics segment, but this could happen in the future as both segments grow. There is an immediate desire to sell the Engineered Materials segment once the RV industry recovers from its trough.

- M&A Opportunity. Management reiterated their desire to conduct M&A and highlighted the interesting opportunities in avionics, niche defense products and the pharmaceutical industry. Current M&A capacity is $1bn and will be over $4bn by 2028. The pipeline is more robust with a larger amount of willing sellers. The recovery in the A&D industry from the pandemic and positive tailwinds has be a driving factor of the increased number of companies being put up for sale.

- Pricing Upside. Value based pricing provides upside to Crane’s guidance. Management understands in many situations that Crane is the only producer of a certain product, which is critical for a customer’s operation. Thus, customers are willing to pay more to get the equipment they need even if at a much higher price. In many scenarios, Crane has doubled prices and for specialized work with minimal push back. Management is working to understand the importance of its products to customers so they can price Crane’s services accordingly.

Curtiss Wright (CW – $310.22 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Headquartered in Davidson, North Carolina, Curtiss-Wright Corporation is a global integrated business that provides engineered products, solutions, and services mainly to aerospace and defense markets, and critical technologies in demanding commercial power, process, and industrial markets. The company’s Aerospace & Industrial segment consists of businesses that provide a diversified offering of engineered products and services supporting critical applications primarily across the commercial aerospace and general industrial markets. Its Defense Electronics segment comprises businesses that primarily provide products to the defense markets and to a lesser extent the commercial aerospace market. Its Naval & Power segment comprises businesses that provide products to the naval defense market and, to a lesser extent, the power and process and aerospace defense markets. This segment also offers simulation technology that supports the design, commissioning, and operation of commercial nuclear power generation and process plant.

Reason For Comment

The following are key takeaways from Curtiss Wright’s CEO Lynn Bamford and CFO Chris Farkas at our 30th Annual Aerospace & Defense Conference:

- Overview. Curtiss Wright is experience strength across all of its business lines. Book-to-bill has been strong and remains well above 1x with a backlog of $3.2bn. One targeted area of focus is internal spending for future technologies, particularly in electronic manufacturing. There are also R&D investments being made within the Defense Electronics Group, Over time, management believes these investments will allow Curtiss Wright to maintain its attractive sales growth, while also expanding operating margins.

- Commercial Aerospace. Curtiss Wright has been in the commercial aerospace business since the inception of aviation with the Wright Brothers. The company has strong relationships with both Boeing and Airbus and primarily manufactures sensors and avionics. The mix between OEM and Aftermarket is approximately 90% and 10%, respectively. Despite the current issues at Boeing, the company remains confident in its positioning and raised its guidance by 3%. The key will be a normalization in OEM build rates over the next few years.

- International Opportunities. Global defense spending makes Defense Electronics a $2 trillion market. Its estimated spending will be up 18% this year, which is the largest increase in decades. Currently, Curtiss Wright is on over 400 platforms with 3,000 total programs. The company is seeing naval aircraft production and orders starting to ramp up. Overall, the key is for NATO to commit to increased spending.

- Commercial Nuclear. Curtiss Wright’s commercial nuclear business is expected to grow at low double- digits and double in size by 2028. Notably, 2023 was the first year a reactor was not shut down in decades. The shift towards nuclear and carbon energy has pushed demand forward. The company expects to build over 300 small modular reactors (SMRs) by the middle of the next decade.

Ducommun (DCO – $64.94 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Ducommun, based in Santa Ana, CA, is a leading global provider of engineering and manufacturing services for high-performance products and high-cost-of failure applications used primarily in the aerospace and defense, industrial and medical industries. The company operates through two primary segments: Electronic Systems and Structural Systems.

Reason For Comment

The following are key takeaways from Ducommun’s CFO Summan Mookerji at our 30thAnnual Aerospace & Defense Conference:

- Background. Ducommun generated LTM sales of $767m, which was approximately 53% defense and 42% commercial aerospace. The remaining percentage is other industrial and medical. The company’s main defense platforms are the Apache, missile programs, and radar platforms. On the commercial side, the business is skewed to narrowbody, but there is still meaningful content on the 787. Ducommun is a tier 1 supplier to Boeing, Raytheon and Lockheed Martin.

- Defense Demand. Ducommun has planned over the last few years to position itself on next generation programs that will drive growth. The main areas of focus include missile defense, radar systems and electronic warfare. The company is well positioned across the board to benefit from the increased defense spending environment. Unlike the aerospace segment, which derives a large portion of sales from the 737 MAX, the defense business has no platform that accounts for greater than 10% of its sales.

- Product Overview. Ducommun’s products are split between two main segments which are Electronic Systems and Structures. According to management, the ROIC associated with the Electronic Systems segment is much higher than that of Structures. This is due to the proprietary status of many of the electronic components Ducommun manufactures.

- Vision 2027. Ducommun’s Vision 2027 plan remains on track. The key financial highlights include growing sales from $700m to $1bn as well as attaining EBITDA margins of 20%. The company has done a good job expanding its engineered products and aftermarket offerings. This has allowed Ducommun to generate more attractive margins with a more stable revenue base. The company expects to continue executing its M&A strategy to acquire niche proprietary product manufacturers.

- Restructuring. The plan is progressing well and currently shutting down a facility in Monrovia, CA and Berryville, AR. Ducommun is going to move some manufacturing work to Guaynas Mexico where it can achieve better operating margins. Management estimates the company will save $11-13m annually.

Elbit Systems (ESLT – $198.44 – NASDAQ) Aerospace Conference Highlights

COMPANY OVERVIEW

Elbit Systems Ltd., based in Haifa, Israel, is an international high technology company engaged in a wide range of defense, homeland security and commercial programs throughout the world. The company, which includes Elbit Systems and its subsidiaries, operates in the areas of aerospace, land and naval systems, command, control, communications, computers, intelligence surveillance and reconnaissance (“C4ISR”), unmanned aircraft systems, advanced electro-optics, electro-optic space systems, EW suites, signal intelligence systems, data links and communications systems, radios, cyber-based systems and munitions. The company also focuses on the upgrading of existing platforms, developing new technologies for defense, homeland security and commercial applications and providing a range of support services, including training and simulation systems.

Reason For Comment

The following are key takeaways from Elbit’s CFO Dr. Kobi Kagan at our 30th Annual Aerospace & Defense Conference:

- Strong Backlog. Elbit has been able to successfully grow their global backlog to ~$22bn. Two driving factors are the increased demand in Europe as a reaction to the Ukraine War and the October 7th attacks in Israel. European governments are seeking to build up stockpiles to prepare for any additional conflicts. Conflict in the Middle East continues to lead to elevated levels of defense spending.

- Growth Strategy. Elbit implements a global growth strategy whereby it establishes a physical footprint and develops a relationship with the local government. The company has been able to execute this approach throughout different parts of the world, such as in Europe, the United States and Asia. The diverse geographical nature of Elbit can allow for steady growth moving forward, rather than being tied to one government’s defense spending budget.

- Capital Allocation. Elbit has a healthy balance sheet of 1.5x net debt to EBITDA. The company has aggressively acquired smaller, private defense companies to add within its growing portfolio. Currently, Elbit is more focused on international acquisitions, especially in the US. Otherwise, the company is investing in an ERP system, as well as robotics and machinery to improve manufacturing efficiency.

- Expansion Plans. Elbit projects revenue of $7.0-7.5bn in 2025, and greater in 2026. As it relates to sustained earnings growth, the key will be to increase operating margins. In particular, the United States has been an unprofitable region for the company. Elbit is seeing the largest growth in its land segment, which should allow the company to drive further sales. This can allow Elbit to realize better operating leverage due to its high fixed cost structure.

Graham Corp (GHM – $29.84 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Graham Corporation is engaged in the design and manufacture of fluid, power, heat transfer and vacuum technologies for the defense, space, energy, and process industries. Its Graham Manufacturing and Barber-Nichols global brands are built upon engineering expertise in vacuum and heat transfer, cryogenic pumps, and turbomachinery technologies. For the defense industry, its equipment is used in nuclear and non-nuclear propulsion, power, fluid transfer, and thermal management systems. For the space industry, its equipment is used in propulsion, power, and energy management systems and for life support systems. For the chemical and petrochemical industries, its equipment is used in fertilizer, ethylene, methanol, and downstream chemical facilities. It offers products for power plant systems, torpedo ejection and power systems, thermal management systems, power generation systems, thermal management systems, chemical and petrochemical processing, and cooling systems, among others.

Reason For Comment

The following are key takeaways from Graham’s CEO Dan Thoren at our 30thAnnual Aerospace & Defense Conference:

- Strong Defense Market Momentum. Graham has made a significant shift to defense end markets over the last four years. In 2021, defense revenues were only 25% of total sales, whereas in 2025 they are expected to be ~56%. The company’s biggest customer is the US Navy, where it is the sole source supplier for many programs. Additionally, there are robust opportunities in space. Graham provides key solutions such as fluid movement for launch vehicles, including rocket engine turbo pumps and thermal management systems on satellites.

- R&D Expansion. Graham had struggled to invest in R&D due to the cyclical nature of its energy market exposure. However, the company is now increasing R&D investments. Graham focuses on products that save energy or power density. The environment is becoming more competitive and R&D is critical. The company has a large installed base, so the focus is on improving products to enhance the installed base.

- M&A. Graham has a focus on engineered products that it can manufacture itself. The Barber Nichols acquisition has been integrated smoothly, with Graham is looking for similar deal profiles. In particular, the company is targeting the full lifecycle of products. As a relatively new business in M&A, Graham is starting to create a playbook of continual improvement organically and inorganically.

- Summarizing Highlights. Graham is a well-managed business under the new leadership team who took over approximately three years ago. The company’s medium-term (Fiscal 2027) targets are EBITDA of $250m, gross profit in the high 20s and low-to-mid teen EBITDA margins. Currently, Graham is on track to meet and exceed these goals. Additionally, Graham has a strong net cash balance sheet and will generate substantial free cash flow over the next four years, providing capital allocation upside.

HEICO (HEI’A – $203.36 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

HEICO Corporation is a manufacturer of jet engine and aircraft component replacement parts. The company’s segments include Flight Support Group (FSG) and Electronic Technologies Group (ETG). FSG segment consists of HEICO Aerospace Holdings Corp. and HEICO Flight Support Corp. and their subsidiaries. FSG uses technology to design and manufacture jet engine and aircraft component replacement parts. FSG repairs, overhauls and distributes jet engine and aircraft components, avionics and instruments for domestic and foreign commercial air carriers and aircraft repair companies, as well as military and business aircraft operators. ETG segment consists of HEICO Electronic Technologies Corp. and its subsidiaries. ETG designs, manufactures and sells various types of electronic, data and microwave, and electro-optical products, including infrared simulation and test equipment, laser rangefinder receivers, electrical power supplies, back-up power supplies and others.

Reason For Comment

The following are key takeaways from HEICO’s Co-President Victor Mendelson at our 30th Annual Aerospace & Defense Conference:

- Great Aftermarket Exposure. HEICO is the premier company in the A&D industry for investors to gain aftermarket exposure. Management anticipates strong demand in commercial, defense and space. As more planes continue to age and need spare parts, HEICO will be there to supply them through their Flight Support Group division. Additionally, the company noted commercial air travel continues to remain strong. Furthermore, HEICO is set to benefit from the delayed OEM ramp and elevated fleet age. These older planes will be in greater need of spare parts, which should continue to be an attractive opportunity for HEICO.

- Shares Gains in PMA. Despite having built an extensive parts manufacturer approval (PMA) portfolio over 30 years, HEICO sees further penetration opportunities. The company is taking market share with PMA orders from OEMs with a lot of runway still on the horizon. PMA approval is very difficult, which could take years and millions of dollars for just a single part. HEICO benefits from this approval moat the FAA created for flight safety.

- Wencor Update. The Wencor acquisition from May 2023 has been very successful. HEICO acquired Wencor for $2.05 billion or 12.9x EBITDA. The deal has been highly accretive given that HEICO shares trade close to 30x EBITDA and $150m of the deal was financed from issuing new HEICO stock, thus creating a multiple arbitrage. Management noted in particular they are looking to execute new deals within the Electronic Technologies Group (Wencor is within HEICO’s Flight Support Group). Lastly, the M&A pipeline across the board has become more attractive with underlying fundamentals improving and more sellers coming to market. Positively, as of now, the FTC has not intervened in its acquisition strategy.

Kopin Corp. (KOPN – $0.93 – NASDAQ) Aerospace Conference Highlights

COMPANY OVERVIEW

Kopin Corporation is a developer and provider of application-specific optical solutions consisting of high-resolution micro-displays and optics, subassemblies, and headsets. The company offers various display technologies, such as micro inorganic light emitting diode (MicroLED), organic light emitting diode (OLED), liquid crystal on silicon (LCOS), and active-matrix liquid crystal displays (AMLCDs) with specific optical designs, and drive electronics in a subassembly for the customer’s particular application. The subassemblies that the Company offers combine one or two of its displays, backlight, application specific integrated circuits (ASICs), complex optics, and other electronics in an assembly that is then included in a larger system. The company’s products are used for defense applications (thermal weapon rifle sights, fixed and rotary wing pilot helmets, and training and simulation headsets); industrial and medical headsets, and three-dimensional (3D) optical inspection systems.

Reason For Comment

The following are key takeaways from Kopin’s CEO Michael Murray at our 30th Annual Aerospace & Defense Conference:

- Shift in Strategy. Michael Murray joined Kopin as CEO in 2022. He has extensive semiconductor industry experience, where he worked on the consumer side of Analog Devices for 10 years. Since taking over the CEO role, there has been a greater emphasis on a shift towards defense end markets. As a result, quality of product became even more important for the customer, which is the Department of Defense. Currently, the focus is on improving gross margin and profitability while putting a 2016 lawsuit in the rear view.

- Profitability Inflection. Kopin has won several new contracts on the F-35 and Abrams tank programs. To turn profitable Kopin needs to scale to better spread its fixed costs. Recently, the company announced an equity offering to raise $27m in cash at $0.65 per share. If Kopin can successfully scale volumes on these programs, the company should generate positive net income.

- End User Focus. Kopin has an acute focus to the end user experience. The soldier/operator experience is paramount in the design process. As a result, Kopin is better able to tailor its products to enhance the warfighter’s capabilities. The company has both color and thermal night vision, which was developed from operator feedback.

- Impact of A/R & V/R on Defense. Kopin’s objective is to enable operators to spot the enemy before they can be spotted themselves. This has become the key to warfare. Additionally, the company wants its micro-displays to be seamless and easy to use. Kopin has made significant progress towards a human centric approach. Currently, the company cost structure is improving and has been successful in finding partners for fabs.

Moog (MOG’A – $199.36 – NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Moog Inc. is a worldwide manufacturer of precision control components and systems. Moog’s control systems are on military and commercial aircraft, satellites, space and launch vehicles, missiles, automated industrial machinery, marine application and medical equipment. Aircraft Controls manufactures and integrates primary and secondary flight controls for military and commercial aircraft as well as providing aftermarket support. Space Controls specializes in complex motion and fluid controls systems for difficult operating environments. Its markets include satellites and space vehicles, defense controls, launch vehicles, strategic missiles, missile defense and tactical missiles. Industrial Controls serve the plastics making machinery, simulation, power generating turbines, test, metal forming and heavy industries. Its products range from injection and blow molding machines to electromechanical motion simulation bases to electrical and hydraulic servovalves. Components’ primary products are slip rings, fiber optic rotary joints and motors.

Reason For Comment

The following are key takeaways from Moog’s CEO Pat Roche and CFO Jennifer Walter at our 30th Annual Aerospace & Defense Conference:

- Cross-Industry Technology. Moog is primarily an aerospace and defense company, but it also operates an industrial equipment business. Management has intelligently identified cross-selling opportunities where some equipment can be slightly modified from a defense use to an industrial purpose. For instance, Moog was trying to address a construction machine problem, but the engineers within the division could not solve it. Management used engineers from the aerospace segment to solve this. According to management, there are many low hanging fruit opportunities to cross-sell and increase margin.

- Operational Efficiencies. Moog has been working to consolidate its factory footprint to streamline operations. Management highlighted its 80/20 plan, which will be 80% cost cutting and 20% price increases to achieve higher margins. The plan has been effective, but there is still opportunity ahead to close redundant factories. Additionally, management is placing a greater focus on value-based pricing. Given that Moog has a large portfolio of proprietary aviation products, the company will have large potential to raise prices without a demand drop-off.

- 2026 Targets on Track. Management reiterated their ability to hit the guidance laid out during its investor day in early June. Assuming the successful OEM ramp in monthly production rates, Moog’s guidance could prove to be conservative and have additional upside.

- FLRAA Exposure. Management is excited about being placed under contract with Textron to work on the next generation V-280. Initially, the contract will fund core design and development activities through the Middle Tier Acquisition phase of the program. Moog products on the V-280 include actuators, cockpit controls and converter units. Once FLRAA goes into full production, the program will be highly profitable for Moog.

Park Aerospace (PKE – $13.61– NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Headquartered in Westbury, New York, Park Aerospace Corp, formerly known as Park Electrochemical Corp, is an aerospace company that develops and manufactures solution and hot-melt advanced composite materials used to produce composite structures for the aerospace market in North America, Asia, and Europe. It offers advanced composite materials, including film adhesives and lightning strike protection materials that are used to produce primary and secondary structures for jet engines, large and regional transport aircrafts, military aircrafts, unmanned aerial vehicles, business jets, general aviation aircrafts, and rotary wing aircrafts. The company also provides specialty ablative materials for rocket motors and nozzles; and specially designed materials for radome applications. In addition, it designs and fabricates composite parts, structures and assemblies, and low volume tooling for the aerospace industry.

Reason For Comment

The following are key takeaways from Park’s CFO Matt Farabough at our 30thAnnual Aerospace & Defense Conference:

- Facility Expansion Complete. In 2018, Park announced it would be expanding its Newton, KS Manufacturing and Development Facilities. The expansion, which was completed in 2023, added 90k square and cost approximately $20m. This doubled the size of the Newton facility.

- Niche Military Programs. Park is pushing to expand into niche military programs, which has been a strong market. The main programs are rocket nozzles, aircraft structures and drones. The company pointed to the Ukraine War as a driving factor for increased demand. Park thinks foreign governments are looking to stockpile even after the conflict concludes, which will lead to a period of elevated demand.

- Supply Chain Update. According to Park, the supply chain was the main impediment to recovery and ramp up for both military and commercial aerospace industries. Positively, demand remains strong. Electronic components, engines and raw materials were the largest drivers in delays. Park was able to circumvent raw material delays and delivered to Airbus on time.

- Cash Rich Balance Sheet. Park has zero long-term debt and reported $74m of cash and marketable securities during its last earnings report. The company has paid a regular cash dividend for 38 years without skipping a payment. In total, Park has distributed more than $583m or about $28.50 per share since 2005.

- GE Aviation Update. Park is the sole source supplier for composite materials on engine nacelles and thrust reversers for multiple Middle River Aerostructure Systems, including the A319neo and A320neo with LEAP-1A engines, along with many more. Engine shipments are expected to continue ramping up, which will be a nice tailwind for Park.

Redwire (RDW – $6.43- NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Redwire Corporation is a global space infrastructure and innovation company enabling civil, commercial, and national security programs. The Company develops and provides core space infrastructure offerings for government and commercial customers through long-duration projects. These core offerings include technologies and production capabilities for avionics and sensors; power generation; structures and mechanisms; radio frequency systems; platforms, payloads and missions; and microgravity payloads. The Company serves both United States and international customers with these core offerings that have civil space, national security and commercial applications. Its spacecraft portfolio supports specialized national security space missions in geostationary orbit. The Company’s products and solutions include antennas, satellite technology, space-qualified sensors, deployable space structure, berthing and docking equipment, and space-enabled manufacturing payloads.

Reason For Comment

The following are key takeaways from Redwire’s CEO Peter Cannito and CFO Johnatan Baliff at our 30th Annual Aerospace & Defense Conference:

- Growth Strategy. The growth strategy consists of four parts. First, protecting the core. This is part of the heritage strategy and keeping current customers happy as Redwire has deep customer relations through these heritage organizations. Second is scaling production. Certain product lines are starting to hit scale, and the company needs to start winning contracts. Third is moving up the value chain. Redwire wants to prime a few technologies based on where the puck is going. The fourth key is venture optionality. Forward technologies regarding space manufacturing gives Redwire optionality.

- Customer Mix. Customers fall into four main buckets: commercial, national security and civil customers. 80% of customer contracts are fixed price and Redwire is paid in advance before launch, which gives good visibility to cash flow. Currently, the focus is on developing better unit economies so the company can profitably scale. Notably, Redwire has had positive EBITDA for the last two years, which has funded growth.

- Hera Acquisition Advantage. The satellite architecture, proliferated LEO, is smaller and less expansive. Also, it has a hybrid structure. Customers are looking for smaller ones and want to know if Redwire can do the same in the GEO space. As it stands, Redwire will not have as many satellites in GEO as LEO. Currently, the company is in a sweet spot where Hera already has some of the IP to develop these technologies. The key is commercializing the product.

- Other Manufacturing Options. Recently, Redwire printed a human meniscus. This gives the company venture optionality. When people try to 3D print on earth, specifically organs, materials need to be injected to stabilize them. In space, you do not have that problem, which is why NASA continues to invest in this area.

Textron (TXT – $87.80- NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Textron Inc. is a multi-industry company that leverages its global network of aircraft, defense, industrial and finance businesses to provide customers with various solutions and services. The company’s segments include Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. Textron Aviation segment manufactures, sells and services Cessna and Beechcraft aircraft, and services the Hawker brand of business jets. Bell segment supplies military and commercial helicopters, tiltrotor aircraft, and related spare parts and services in the world. Textron Systems segment offers electronic systems and solutions, advanced marine craft, piston aircraft engines, and others. Industrial segment designs and manufactures a variety of products within the Kautex and Specialized Vehicles product lines. Textron eAviation segment includes Pipistrel, a manufacturer of light aircraft, along with other research and development initiatives related to sustainable aviation solutions.

Reason For Comment

The following are key takeaways from Textron’s CFO Frank Connor at our 30th Annual Aerospace & Defense Conference:

- Aviation Update. Textron Aviation’s backlog grew 10% or $662m from last year to $7.5bn. Lead times remain in the 1.5 to 2 year range. The supply chain continues to slow down deliveries, but is expected to improve after this year. Price continues to be an attractive lever for Textron to utilize as demand for air travel remains high. The underlying jet market fundamentals continue to remain strong, with used jet inventory at a healthy level.

- FLRAA Strength. Textron’s Bell segment delivered a strong quarter, driven by the FLRAA program. Military volumes were up $104m from last year. The total backlog declined to $4.2bn, which is down 25% from 2023. The award for the $70bn FLRAA program to replace the US Army Black Hawks is anticipated to drive a return to growth for Bell. The program is expected to contribute $1bn of sales in 2025 and continue to grow.

- eAviation. In April 2022, Textron acquired Pipistrel, an electric aviation company, for $240m. Currently, Pipistrel is generating annual run-rate revenues of $40m. The acquisition was intended to support Textron’s push into sustainable aviation comprising legacy electrification R&D efforts. Pipistrel generated modestly positive operating profit prior to the acquisition but will continue to generate losses as it scales.

- Supply Chain. The challenges have continued to move around to different parts of the supply chain, which has been a frustrating development. Airplanes are assembled in a set sequence, so not having the necessary part at the right time throws off the whole manufacturing process. Challenges have included everything from aluminum spars, which start airplanes to shortages of aviation glass, which affect cockpit windows. The difficultly is the lack of consistency, which makes it harder to plan ahead.

VSE Corp. (VSEC – $87.90- NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

VSE Corporation is a provider of aftermarket distribution and maintenance, repair and overhaul (MRO) services for air and land transportation assets for commercial and government markets. Its Aviation segment provides aftermarket parts distribution and MRO services for components and engine accessories supporting commercial, business and general aviation operators. This business offers a range of services to a diversified global client base of commercial airlines, regional airlines, cargo transporters, MRO integrators and providers, aviation manufacturers, corporate and private aircraft owners, and fixed-base operators. Its Fleet segment is specialized in part distribution, engineering solutions, and supply chain management services supporting the medium and heavy-duty fleet market. Fleet segment operations are conducted under the brand Wheeler Fleet Solutions, which supports government and commercial truck fleets with parts, sustainment solutions and managed inventory services.

Reason For Comment

The following are key takeaways from VSE Corp’s CEO John Cuomo at our 30th Annual Aerospace & Defense Conference:

- Transformation. VSE has transformed over the last few years by addressing a value proposition the market was missing. The company was able to provide aftermarket work and meet customer demand. According to management, 80% of market share gains over the last nine years have come from OEMs who had been doing the work themselves but were not looking to optimize by outsourcing. On the trucking side, parts distribution used to be 90% USPS, which has been diversified away to only 40% by expanding business to other companies.

- Aviation Segment. VSE has been able to win business through large OEMs who needed to outsource the repair network. OEMs have new parts but do not have enough capacity to repair them. Additionally, VSE has been able to win new business through competitive bid processes. VSE has the potential to outgrow the market by winning new contracts and taking market share. Additionally, the company has had a successful M&A track record, which has fueled inorganic growth.

- Recent Acquisitions. Recently, VSE purchased Desser Aerospace. The company has a robust aftermarket repair capability, as well as a proprietary portfolio of aerospace parts. The aerospace parts portfolio was divested to Loar Group. Integration has gone well so far and management thinks VSE can be more competitive on price. Further, there has been growth in current customer relationships. VSE’s largest customer is British Airways.

- Competitive Advantage. There are parts and lead times that are 20 to 30 weeks and could be as high as 60 weeks. Of this, approximately 65% of parts are late. There continues to be major supply chain issues, and it is consistent across multiple production companies. The supply network is highly complicated, and the focus remains on avoiding missed shipments. VSE is able to adjust for delays and meet demand, while still protecting OEM IP.

Woodward (WWD – $167.36- NYSE) Aerospace Conference Highlights

COMPANY OVERVIEW

Woodward Inc., based in Fort Collins, CO, is a manufacturer and service provider of control solutions for the aerospace and industrial markets. The company operates in two segments: Aerospace and Industrial. Woodward products include fuel pumps, metering units, actuators, air valves, specialty valves, fuel nozzles, and thrust reverser actuation systems for turbine engines and nacelles, as well as flight deck controls. These products are used on commercial and private aircraft and rotorcraft, as well as military fixed-wing aircraft and rotorcraft.

Reason For Comment

The following are key takeaways from Woodward’s Director of Investor Relations Dan Provaznik at our 30thAnnual Aerospace & Defense Conference:

- Commercial Aerospace. Woodward is participating in the ramp of the 737 Max and the A320neo with its actuation and motion control products. Additionally, the company has significant content on the LEAP and GTF engines. Long term, Woodward is well positioned across a diverse set of dominant, high production platforms.

- Supply Chain Stabilizing. Given the constantly changing supply chain, Woodward has been investing to guarantee continuity. The company had many supply chain related difficulties in 2022. Woodward is working to identify potential issues quarters in advance, so solutions can be created in the present. Previously, there were large inefficiencies with the labor force because parts were not available to be utilized.

- Broad Defense Exposure. Woodward has been in defense for many years, but it is not the company’s primary focus. Currently, Woodward has content on the F-35, F-16, F-18, and many more key platforms. On a negative note, guided weapons have seen a decline in demand. However, this could reverse as governments look to stockpile reserves after witnessing these weapons used in Ukraine.

- Industrial Business. The industrial business essentially has the same function as products in Woodward’s aerospace business. For instance, a fuel-metering device on the LEAP engine can have many similarities to that used for industrial purposes. The focus is fuel and motion control, and oil and air management systems. Additionally, Woodward has seen some sales volatility for a fuel control system in China that goes into a natural gas truck engine. Unfortunately, there is minimal long-term visibility, unlike for the aerospace segment.

- Aerospace Aftermarket. Pre-2020, Woodward took a cost-plus approach to pricing. Starting in 2021 and 2022, the company identified the inflationary pressures on the business and began to take more price. Additionally, Woodward is the sole source manufacturer for many products, which allows it to price a product commensurate with its true value customers, which was not the case in the past. In 2023, the company targeted a 5% price increase, but now it will be around 7%.

ONE CORPORATE CENTER RYE, NY 10580 Gabelli Funds TEL (914) 921-5000

This whitepaper was prepared by Tony Bancroft, and Michael Burgio. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The Research Analyst’s views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual Research Analyst’s as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Research Analyst or of the Firm as a whole.

As of June 30, 2024, affiliates of GAMCO Investors, Inc. beneficially owned 5.91% of of Ducommun, 3.79% of Graham Corporation, 3.64% of Crane Co., 3.34% of Park Aerospace, 1.64% of Astronics Class A and less than 1% of Class B, 1.41% of Textron, 1.03% of AAR, less than 1% of HEICO Corporation Class A and Class B, less than 1% of Moog Inc. Class B and less than 1% of Class A, and less than 1% of all other companies mentioned.

One of our affiliates serves as an investment advisor to Crane Co. or affiliated entities and has received compensation within the past twelve months for these non-investment banking securities-related services.