The aerospace & defense sector is at an inflection point. From surging global defense budgets to the rebound in commercial air travel, long-term tailwinds are creating compelling opportunities for investors. LtCol Tony Bancroft, USMCR, Portfolio Manager of the Gabelli Commercial Aerospace and Defense ETF, provides five reasons this sector deserves attention today.

1. Surging Global Defense Spending

- NATO recently increased its defense spending target to 5% of GDP.

- The U.S. defense budget request for FY2026 surpassed $1 trillion — the largest in history.

- Ukraine has significantly depleted Western missile and ammunition stockpiles, highlighting the need for replenishment and modernization.

Investor takeaway: Sustained and growing procurement budgets create durable demand for companies like Lockheed Martin, Northrop Grumman, and tier-one suppliers.

2. Commercial Aviation Recovery & Backlogs

- Global air travel has returned to pre-pandemic levels, with international travel up 3.5% YoY.

- Boeing and Airbus project nearly 44,000 aircraft deliveries by 2044.

- Airlines are locking in orders now for delivery slots post-2030, fueling record backlogs (Boeing’s exceeds $500B).

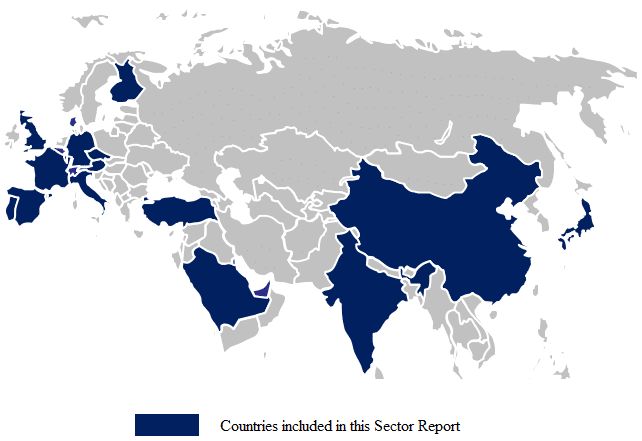

Investor takeaway: OEMs and suppliers are positioned for multi-decade growth as airlines modernize fleets to meet rising middle-class demand, especially in Asia and India.

3. Technology & Innovation Driving the Future

- Next-gen defense tech: AI, drones, cyber, hypersonics, and precision weapons are being incorporated into modern aerospace technology.

- In commercial markets, lightweight composites like Hexcel’s carbon fiber, now comprise over 50% of widebody aircraft structures.

- Autonomy & drones are reshaping ISR (intelligence, surveillance, reconnaissance) and strike capabilities.

Investor takeaway: Long-cycle innovation creates structural growth, benefiting both primary and niche suppliers.

4. High-Margin Aftermarket Growth

- The aerospace aftermarket is expected to grow at a high single-digit annual rate as global air travel demand once again outpaces overall economic growth.

- Airlines are extending the service lives of existing fleets, which drives increased demand for maintenance, overhauls, and replacement parts.

- Specialized companies such as HEICO and GE benefit from FAA-approved parts and aftermarket services that generate recurring, high-margin revenues.

Investor takeaway: Aftermarket revenues are recurring, high-margin, and resilient through cycles.

5. M&A and Consolidation Opportunities

- Strategic acquirers and private equity firms are actively pursuing acquisitions of niche suppliers with proprietary technologies and strong aftermarket exposure. Recent transactions such as L3 Harris’s purchase of Aerojet Rocketdyne and HEICO’s acquisition of Wencor illustrate this trend.

- The pace of deal-making is expected to accelerate as valuations normalize and operators seek to secure scarce capabilities in areas like advanced materials and electronic systems.

- Industry consolidation is reshaping competitive dynamics, creating larger, more diversified platforms that can capture long-cycle growth and drive shareholder value.

Investor takeaway: The A&D industry is experiencing structural growth, consolidation, and innovation — positioning investors for long-term opportunities.

How to Invest in Aerospace and Defense

The aerospace & defense sector offers a rare blend of long-cycle demand, structural growth themes, and defensive characteristics. For investors seeking exposure to this critical industry, the Gabelli Commercial Aerospace & Defense ETF (GCAD) provides diversified access to leading companies positioned to benefit from these secular tailwinds.

To learn more visit https://gabelli.com/ticker/gcad/.