Reflections from Gabelli Funds’ 17th Annual Media & Entertainment Symposium

Gabelli Funds hosted its 17th Annual Media & Sports Symposium at the Harvard Club in New York City on Thursday, June 5, 2025. The symposium featured discussions with leading companies and organizations across the media ecosystem, with an emphasis on industry dynamics, current trends, and business fundamentals, as well as Sports Investing, Media & Telecom Regulatory, and Advertising Panels. Attendees also had the opportunity to meet with management in a one-on-one setting.

Key Themes: Today’s Changing Media Landscape

Broadcasters’ revenue profiles are less dependent on core advertising spending than in historical periods, and improved packaging on the distribution side is starting to show improvements in pay-tv subscriber losses. Broadcasters continue to aggressively drive contractually recurring retransmission fees, and political ad dollars again reached record levels during the 2024 presidential election cycle. While core ads are highly volatile during recessionary periods (during ‘08-‘09, U.S. advertising saw steep declines of >15%), politicians and PACs are expected to remain well-financed heading into the 2026 midterms. Local TV continues to be the primary beneficiary of political spending, and given low variable costs, generally fall to a broadcaster’s bottom line.

Cord Cutting & Shaving: From a peak of over 100 million total pay-tv subscribers in 2015, 2024 ended with just under 70 million, representing around 55% household penetration (down from a peak of over 80%). Virtual MVPDs have become increasingly prevalent as younger consumers continue to shave and cut the cord, and these services continue to take share from traditional pay-tv offerings. Growth in virtual MVPD subscribers to date had helped offset some of the declines on the traditional MVPD side, although not fully, but this has started to moderate. On a legacy basis, trailing 12-month declines have started to show slight improvement (vs. recent declines of >12%) as cable operators continue to improve MVPD packaging – bundling and video attach alongside broadband while also including DTC streaming services to enhance value. Skinny bundles centered on broadcast, sports, news, and streaming are expected to proliferate moving forward, and we view broadcast as a key beneficiary of these dynamics.

Core Advertising Trends: Pressure continues to mount from reduced linear viewership across the industry, with broadcasters calling out early macro headwinds related to tariffs and uncertainty. Linear advertising continues to see sports and news gain momentum, while general entertainment trends continue to show softness. Broadcasting companies’ revenue will likely be negatively impacted, at least in the near-term, as a result of exposure to advertising. However, the impact is somewhat mitigated by broadcasters’ diversified sources of revenue today, as non-political (‘core’) advertising comprises less than 50% of a pure-play broadcaster’s revenues (vs. about 90% during the last recessionary period). The economic outlook in the U.S. remains uncertain, and macro dynamics continue to have an impact on corporate advertising and marketing budgets, which are often viewed as discretionary.

Broadcast Positioned to Benefit from Competitive 2026 Election Cycle: In contrast to recent softness in core advertising, U.S. political advertising again reached record levels during the 2024 presidential election cycle. While digital media, driven primarily by CTV, continues to capture a growing share of political spend, broadcast has remained resilient in absolute dollar terms, maintaining its role as a critical reach vehicle for campaigns. Local broadcast stations are uniquely positioned to attract political ad dollars due to the regional nature of their signals and their ability to reach older, more likely voters – making them especially effective relative to other media channels. Looking ahead to 2026, the highly contested political environment is expected to drive further growth over the 2022 midterms. With razor-thin majorities in both the House and Senate, and control of both chambers potentially in play, political spending should remain robust. Stations serving markets with competitive races are likely to outperform, as these contests typically generate the highest levels of political advertising revenue.

Optimism for Broadcast Deregulation & M&A Activity: Across the board there is optimism for meaningful deregulation under new FCC Commissioner Brendan Carr, which would likely reignite large-scale broadcast M&A. Local television broadcasters in the U.S. have long been limited by FCC rules designed to preserve localism and media diversity (outlined further below) – most notably, the national ownership cap, which restricts station groups to reaching 39% of total U.S. TV households. However, in a media landscape now dominated by streaming platforms and Big Tech, these rules are increasingly being viewed as outdated and misaligned with modern market dynamics.

- National Television Ownership Cap: Limits a single broadcaster’s reach to 39% of U.S. TV households.

- Local Television Ownership Rules: Prevent ownership of two top-four rated stations in the same market unless a waiver is granted.

- Top Four Network Ownership Rule: Prohibits a single company from owning more than one of the Big Four networks (ABC, CBS, NBC, & FOX).

Momentum is building for a deregulatory agenda that could lift or ease both national and local ownership rules, allow broadcasters to negotiate directly with virtual MVPDs, and sunset ATSC 1.0 in favor of next-gen broadcast standards (ATSC 3.0). If enacted, such reforms could unlock meaningful consolidation opportunities, improve operating efficiency, and better position broadcasters to compete in a digital-first environment. Should the national ownership cap be eliminated – as many anticipate under a Republican-majority FCC – we would expect a meaningful acceleration in consolidation activity. Acquirers are expected to continue realizing synergies from several key areas: after-acquired rights (raising acquired retransmission rates to the acquirer’s rates), in-market operational efficiencies, and back-office and infrastructure consolidation. While after-acquired rights have historically driven the largest near-term EBITDA lift, the gap in retrans rates has narrowed in recent years. As a result, in-market synergies are now seen as the most compelling value driver. These include headcount reductions, but also more meaningful savings from the consolidation of master control operations, broadcast infrastructure, and real estate.

Streaming Wars & Content: Companies across the industry continue to moderate spending on content. So far, Netflix is the only streamer that has been consistently profitable at scale. While the DTC/streaming businesses of many of the legacy large-scale media companies have reached breakeven in certain quarters, they remain focused on determining economic models that further increase profitability to help offset the declines in their legacy broadcast and cable businesses. Advertising is expected to play a larger role in the streaming future – whether through free ad-supported TV (FAST) or advertising-based video on demand (AVOD). Major platforms including Netflix, Disney+, HBO Max, Amazon Prime, and AMC Networks have all launched AVOD tiers. Bundling is also becoming a key strategic focus, particularly for ad-supported offerings.

Bundles offer consumers a lower-cost entry point while enhancing monetization through improved engagement and stronger CPMs enabled by connected TV targeting. While these efforts have not fully offset the erosion of linear TV ad inventory, they provide meaningful support to overall revenue and profitability. Bundled services also tend to exhibit lower churn compared to standalone subscriptions, which are often more sensitive to content pipelines tied to sports schedules or premium scripted releases. We expect bundling to become increasingly prevalent as streaming prices rise and platforms seek to reduce churn. Cross-company bundles are already gaining traction, as seen with Disney/Hulu/Max, Netflix/Max with Verizon, and Comcast’s StreamSaver bundle (Peacock, Netflix, and Apple TV+). We anticipate continued momentum from both streamers and third parties (e.g., cable and telecom operators, Amazon, Apple, etc.), with a particular focus on ad-supported tiers – which allow platforms to accommodate wholesale pricing while still capturing 100% of ad revenue. While bundling is far easier to execute than a full-scale streaming merger, it lacks one of the most compelling benefits: meaningful cost synergies. Mergers offer opportunities to reduce spending across both content and SG&A/technology infrastructure.

Media M&A remains a hot topic following the re-election of President Trump, Paramount’s ownership change (expected completed in the first half of 2025), the planned spin-off of Comcast’s cable networks as Versant, and most recently, Warner Bros. Discovery’s announcement that it plans to separate its Global Networks from its Streaming & Studios business. The Networks segment continues to face structural pressures and would likely trade at a modest multiple. Longer-term value creation for the Networks business may depend on achieving greater scale.

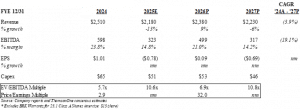

Atlanta Braves Holdings (BATRA/K – $45.56/$42.99 – NASDAQ) Symposium Highlights

| Year | REVENUE | EBITDA | Dividend: None Current Return: Nil | ||

| 2027P | $817M | $72 | Shares Outstanding: 10.3 million Class A (1 vote)

|

||

| 2026P | 735 | 47 | 1.0 ” ” B (10 votes) | ||

| 2025E | 700 | 41 | 51.3 ” ” K (0 votes) | ||

| 2024A | 663 | 40 | 52-Week Range: $44.42 – $35.46 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Headquartered in Atlanta, Georgia, Atlanta Braves Holdings, Inc. owns and operates the Atlanta Braves Major League Baseball Club and The Battery, a mixed-use real estate development centered on the Braves’ Truist Park. The club was founded in 1871 as the Boston Red Stockings and played in Milwaukee before moving to Atlanta in 1966. The Braves have won an MLB record 23 divisional titles, 18 national league pennants, and four World Championships. John Malone’s Liberty Media acquired the Braves in 2007 and took it public via a tracker stock in 2016; the company was split-off as an asset-backed security in July 2023.

Reason for Comment

On June 5, 2024, Atlanta Braves President & CEO Derek Schiller presented at our 17th Annual Media & Sports Symposium. Highlights from the session are included below:

- The Braves market area is among the largest and fastest growing. The bankruptcy of RSN Diamond Sports enabled the unlock of DTC streaming rights and increased reach via broadcaster Gray- overall a better deal.

- The Battery remains an excellent growth opportunity. While 99% occupied, the company has been able to upgrade existing tenants. It is also expanding its footprint organically and inorganically, including via the recent acquisition of Pennant Park, an adjacent office property already used for gameday parking.

- Scheduled changes to the tax code (i.e. §162(m)) that limit the deductibility of compensation for the five highest paid employees of public companies pose special challenges for public teams, probably unintended by the tax writers and something the company and others are actively addressing.

- Overall BATR is still navigating being a relatively new public company and one of the few public sports teams in the market. As a result, the company is even more focused on being good stewards for its brand.

Summary

Sports assets are unusual in that their customers are literally their fans, often transcending economic conditions and generations. Combined with their inherent scarcity, this explains why team values have compounded at ~16% per year for the last decade. The Atlanta Braves represent one of the rare ways for public market investors to benefit from this asset class.

| Table 1 | Atlanta Braves Holdings |

| Earnings Model 2024 – 2027P

|

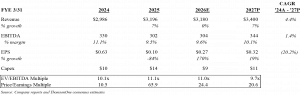

The E.W. Scripps Company (SSP – $2.88 – NASDAQ) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $317M | 10.8x | Dividend: None Current Return: Nil | ||

| 2026P | 499 | 6.9 | Shares Outstanding: 75.8 million Cl. A (1/3 board) | ||

| 2025E | 323 | 10.6 | 11.9 ” Common (2/3 ” ) | ||

| 2024A | 598 | 5.7 | 52-Week Range: $4.06 – $1.36 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

The E.W. Scripps Company is a diversified media enterprise and one of the largest independent owners of local TV stations in the U.S. The company’s Local Media segment operates 61 stations today, reaching over 36% of U.S. TV households. Scripps Networks is comprised of 8 national news and entertainment networks that reach nearly every U.S. household over the air and are also widely distributed on pay-tv and connected TV. Scripps is the nation’s largest holder of broadcast spectrum. The company was founded in 1878, and is headquartered in Cincinnati, Ohio.

Reason for Comment

On June 5, 2025, Scripps’ CFO, Jason Combs and Chief Communications & IR Officer, Carolyn Micheli participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- Scripps’ top priority in 2025 remains debt reduction. Since acquiring ION, the company has allocated 99% of discretionary cash flow toward debt repayment, bringing leverage down from 6.0x to 4.9x, with a target in the low-to-mid 3x’s. Scripps has generated ~$63 million through the sale of smaller, non-strategic real estate assets.

- Scripps is optimistic about the potential for broadcast deregulation under the new FCC, notably changes to the ownership cap and sunsetting of ATSC 1.0. SSP sees an opportunity for swaps and potential asset sales, all of which should lead to further deleveraging.

- Local news and sports remain strategic pillars for SSP, while national ads continue to face pressure from tariffs and broader macro uncertainty. Scripps Sports is a key growth engine, with strong ratings from WNBA and college sports. Networks will benefit from the return of the WNBA and NWSL to ION this year. A large share of ‘25 ad dollars were placed during last year’s upfront, and remaining inventory is commanding premium rates.

- Scripps completed legacy distribution contracts that expired at the end of Q1 covering ~25% of its pay-tv households. Accordingly, both Q2 and FY distribution revenue are expected to be about flat despite sub declines.

Summary

While recent weakness in advertising, particularly on the national side, has created headwinds, Scripps is better positioned to navigate an ad recession today than in prior cycles. SSP reaffirmed that deleveraging remains the company’s top priority, and expressed optimism around potential regulatory reform, which could create strategic M&A opportunities under a more favorable FCC landscape.

| Table 1 | The E.W. Scripps Company |

| Earnings Model 2024 – 2027P |

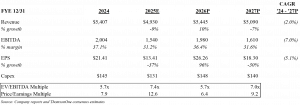

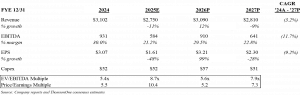

Lionsgate Studios (LION – $6.27 – NYSE) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $344M | 9.7x | Dividend: None Current Return: Nil | ||

| 2026P | 304 | 11.0 | Shares Outstanding: 285.7 million | ||

| 2025E | 302 | 11.1 | 52-Week Range: $9.14 – $5.98 | ||

| 2024A | 330 | 10.1 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Lionsgate Studios is one of the world’s leading standalone, pure play, publicly traded content companies. It brings together diversified motion picture and television production and distribution businesses, a world-class portfolio of valuable brands and franchises, a talent management and production powerhouse and a more than 20,000-title film and TV library. The company recently completed its full tax-free separation from Starz and began trading independently under the ticker LION on the NYSE. Lionsgate’s corporate headquarters are in Santa Monica, California, and it is domiciled in Vancouver, British Columbia.

Reason for Comment

On June 5, 2025, Lionsgate’s Vice Chairman, Michael Burns and CFO, Jimmy Barge participated in a fireside chat at our 17th Annual Media & Sports Symposium. Key highlights from the discussion are included below:

- Now fully separated from Starz as of mid-May, Lionsgate Studios is the only standalone public film and TV studio that, unlike many other names in media, has no direct exposure to the declining linear TV ecosystem.

- When Lionsgate was previously a pure-play, it traded in the low- to mid-teens multiple range, so management anticipates the standalone studio business will trade better than it did coupled with Starz previously.

- Lionsgate’s content library generates roughly $900 million in annual revenue, with ~50% cash margins on library monetization. Management remains focused on multi-platform monetization and highlighted up to 19 distinct revenue streams per film including digital, international, and short-form. Lionsgate is also actively leveraging legacy IP (e.g., Hunger Games, John Wick) across new formats like YouTube, TikTok, and Fortnite.

- With the strong slate of films coming in fiscal ’26, there should be a meaningful improvement in studio profits heading into FY ’27 vs. a challenging fiscal ‘25. LION is targeting 3.5-4.0x leverage for the business, and noted non-core asset sales and M&A as opportunities to improve its capital position and scale further moving forward.

Summary

Lionsgate recently completed its full separation from Starz and is now a pure-play content company. LION should have a much stronger near-term slate, though we expect it to primarily benefit fiscal ‘27 (vs. fiscal ’26). In addition, with ~30% of revenues coming from the existing library, along with pre-sales of international rights, cash flow streams should be more predictable moving forward. We anticipate Lionsgate will ultimately be an attractive takeout target for a strategic buyer in big tech or media; similar assets have historically transacted at ~12-13x EV/EBITDA.

| Table 1 | Lionsgate Studios |

| Earnings Model 2024 – 2027P |

Media & Telecom Regulatory Expert Session Symposium Highlights

We hosted Rob McDowell, Partner at Cooly LLP and former FCC Commissioner for an engaging discussion on the regulatory environment and dynamics impacting the media and telecom industry today.

OVERVIEW

Rob is chair of Cooley’s global communications practice group, and he advises telecommunications, media, space technology, and satellite clients on their most significant regulatory, legal, and business matters. As a former commissioner of the Federal Communications Commission and a highly regarded industry leader, Rob has been at the forefront of the most complex and groundbreaking issues facing the telecom-media-tech sector.

Rob was appointed to the FCC by President George W. Bush in 2006 and was reappointed by President Barack Obama in 2009. He was unanimously confirmed both times by the US Senate. During his tenure, Rob led efforts to expand consumer access to spectrum through his work on the two largest wireless auctions in US history at the time. He also played a key role in the 2009 digital television transition, he and led efforts to establish the first federal civil rights rule in a generation by creating a ban on racially discriminatory practices in broadcast advertising, among many other accomplishments.

While at the FCC, Rob worked extensively on several large and complex mergers, including Sirius and XM; Comcast and NBCUniversal; Verizon and Alltel; AT&T and Dobson; Sprint and Clearwire; Verizon and SpectrumCo; and AT&T and T-Mobile. At Cooley, he represents clients on transformative deals before the FCC, Congress, the White House and other regulatory bodies.

Reason for Comment

On June 5, 2025, Rob McDowell participated in a Media & Telecom Regulatory Expert Session at our 17th Annual Media & Sports Symposium to discuss regulatory dynamics, opportunities, & challenges facing today’s media and telecom industry. Discussion highlights are included below:

- The FCC remains able to function despite lacking a quorum. With only two commissioners, the Chairman can convene a board to act under delegated authority. In this structure, the FCC can approve transactions (including M&A) and handle routine matters like license extensions or revocations. However, it cannot issue new rulemakings or resolve contested proceedings unless delaying action would cause harm or impact the public interest. In effect, the board operates like a 2-2 commission with limited but meaningful powers.

- Trusty is expected to be confirmed following the FCC’s next open meeting on June 26. Several names are being floated as potential nominees for the now-vacant third Republican seat following Simington’s recent resignation.

- Broadcast deregulation remains a top priority for the FCC. While the introduction of a Notice of Proposed Rulemaking (NPRM) has been delayed due to the lack of a quorum, there is a belief that the Media Bureau could still be directed to advance consolidation efforts. The national ownership cap is expected to be eliminated, and local ownership rules are also likely to be loosed. The FCC is also anticipated to address other related issues such as reclassifying virtual MVPDs and sunsetting ASTC 1.0.

- Putting more spectrum into the wireless industry’s hands is a key part of the FCC’s agenda. The House version of the Budget Reconciliation Bill includes a plan to auction at least 600 MHz of mid-band spectrum and restore the FCC’s spectrum auction authority. It is still too early to say which bands will be designated for future auctions, although it is likely that a significant portion of the spectrum will come from the government agencies, including the Department of Defense.

Summary

FCC Commissioner Carr’s deregulatory agenda is setting the stage for a major shift in the local broadcast landscape. Easing ownership caps, restoring direct negotiation rights with vMVPDs, and accelerating the ATSC 3.0 transition collectively represent a policy agenda designed to modernize the broadcast industry. If enacted, these changes could unlock significant consolidation opportunities, improve operating efficiency, and position local broadcasters to compete more effectively in a digital-first media landscape.

Nexstar Media Group (NXST – $169.09 – NASDAQ) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $1,610M | 7.0x | Dividend: $7.44 Current Return: 4.4% | ||

| 2026P | 1,980 | 5.7 | Shares Outstanding: 30.1 million | ||

| 2025E | 1,540 | 7.4 | 52-Week Range: $191.86 – $141.66 | ||

| 2024A | 2,004 | 5.7 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Nexstar Media Group, headquartered in Irving, Texas, is the largest local broadcast television group in the United States Following the acquisition of Tribune in 2019, the company owns or partners with over 200 broadcast stations in 116 markets, reaching ~70% of all U.S. TV households (or roughly 39% after applying the UHF discount). Nexstar also owns News Nation, a national cable network, and has a 75% majority stake in The CW broadcast network.

Reason for Comment

On June 5, 2025, Nexstar’s President & COO, Michael Biard and CFO, Lee Ann Gliha participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- Nexstar is highly optimistic about upcoming broadcast deregulation, which could unlock larger-scale industry consolidation. The FCC has already signaled support by granting waivers for in-market mergers involving a second major network affiliate. Even ahead of formal policy changes, NXST sees near-term opportunities in station swaps to strengthen local market positioning and capture synergies through streamlined operations.

- Approximately 60% of Nexstar’s footprint is up for renewal later in 2025, which should benefit 2026. Nexstar will also renew affiliation agreements covering two-thirds of its CW subscriber base, which is expected to contribute positively to the network’s profitability trajectory; however, most of that impact is expected in 2026.

- The CW is on track to reach breakeven in 2026. Investments in content are expected to drive stronger distribution revenue, viewership, and advertising. Live sports will account for roughly 40% of CW programming in 2025.

- Ad trends should benefit from the programming investments at the CW, though the broader macro may continue to post challenges as well at the local station group. Nexstar anticipates a strong political ad cycle in the 2026 midterms and, with stations reaching nearly 90% of contested electoral markets, is well-positioned to capitalize.

Summary

Nexstar benefits from industry-leading scale in linear TV and an attractive station portfolio. The company has aggressively grown contractually recurring distribution fee revenues, significantly reducing its reliance on more cyclical core advertising. Looking ahead, Nexstar is optimistic about potential broadcast deregulation that could pave the way for broader industry consolidation. With a strong track record of executing large-scale, accretive M&A, Nexstar is well-positioned to capitalize on future opportunities as ownership restrictions ease.

| Table 1 | Nexstar Media Group |

| Earnings Model 2024 – 2027P |

Reservoir Media, Inc. (RSVR – $7.45 – NASDAQ) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $72M | 11.8x | Dividend: None Current Return: Nil | ||

| 2026P | 66 | 12.9 | Shares Outstanding: 65.3 million* | ||

| 2025E | 56 | 15.3 | 52-Week Range: $9.83 – $6.56 | ||

| 2024A | 46 | 18.5 |

Source: Company data and ThomsonOne consensus estimates.

* Excludes 5.9 million warrants, exercise price of $11.50 per share; expire 7/28/26

COMPANY OVERVIEW

Reservoir Media, headquartered in New York City, is a female-founded and -led independent music company with operations focused on the acquisition and monetization of copyrighted music publishing and recording rights. Founded as a family-owned music publisher in 2007, Reservoir has grown into a global platform representing over 150,000 copyrights and 36,000 master recordings, spanning works from the early 1900s to today’s top hits. The company operates through two primary segments: Music Publishing and Recorded Music.

Reason for Comment

On June 5, 2025, Reservoir’s Founder & CEO, Golnar Khosrowshahi and CFO, Jim Heindlmeyer participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- Reservoir operates in a growing industry supported by strong secular tailwinds including further penetration of global paid music subscriptions, continued pricing growth and monetization improvements by DSPs, and the rising adoption of voice activated devices, fitness-integrated audio products, and connected vehicles. New access points such as gaming platforms and social media further expand music’s TAM. Consumption of music doesn’t generally decline in tougher macro environments, and music assets are viewed as somewhat recession resilient.

- RSVR is well-positioned to benefit from these tailwinds in addition to several company-specific value drivers including its proven M&A platform, strategic new signings, and ongoing value enhancement initiatives across sync, digital licensing, etc. which are expected to drive improved operating leverage and cash flow generation.

- FQ4 ’25 revenue and EBITDA both exceeded expectations, and RSVR remains confident that organic revenue growth of 5-10%+ is sustainable longer-term given its success in synch and strong underlying industry tailwinds.

- Publishing still accounts for ~70% of Reservoir’s business with Recorded Music accounting for the remaining 30%. However, Reservoir is not set on that split and will continue to pursue deals wherever opportunities arise.

Summary

As an indie music company with ~1% share in publishing, RSVR has delivered organic growth of nearly 12% CAGR in recent years, significantly outperforming the broader industry. RSVR is widely regarded as a partner of choice for songwriters/artists seeking a true collaborator to help monetize and elevate the value of their work. Reservoir is expected to continue outpacing solid industry fundamentals, driven by its best-in-class value enhancement program.

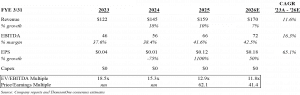

| Table 1 | Reservoir Media |

| Earnings Model 2023 – 2026E |

Rogers Communications (RCI’B – C$37.91 – Toronto) Symposium Highlights

| Year | EBITDA | EV/EBITDA | Dividend: C$2.00 Current Return: 5.3% |

| 2027P | C$10,050M | 5.9x | Shares Outstanding: 538 million consisting of: |

| 2026P | 9,910 | 5.9 | 111 ” Class A (voting) |

| 2025E | 9,710 | 6.1 | 427 ” Class B (non-voting) |

| 2024A | 9,617 | 6.1 | 52-Week Range: C$56.55 – $32.42 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Rogers Communications, headquartered in Toronto, ON, is a diversified communications and media company that owns the largest national wireless service provider (11.9 million customers) and the largest cable MSO (4.3 million broadband connections) in Canada, as well as a media business with a focus on sports and regional TV and radio (including ownership of Toronto Blue Jays baseball club and a 37.5% interest in Maple Leaf Sports & Entertainment (owner of the Toronto Maple Leafs, Toronto Raptors, Toronto FC, etc.)).

Reason for Comment

On June 5, 2025, Rogers Communications’ President and CEO Tony Staffieri participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- RCI continues to expect overall Canadian wireless industry’s volume growth to be ~3% in 2025. RCI is pursuing profitable growth, with a focus on bringing more customers to its flagship Rogers brand. Management expects greater price discipline in the market in the back of the year, with opportunities to return to ARPU growth.

- In cable, the company continues to be focused to returning to consistent moderate top line growth through a combination of increasing broadband market share within its cable footprint, scaling its fixed wireless business (which addresses the markets outside of RCI’s incumbent cable territories), and growing presence within business segment (seeing double digit growth, particularly with small- and mid-sized firms).

- Rogers expects to turn its sports and entertainment assets into a meaningful second pillar of value for the organization. It expects to close the purchase of Bell’s MLSE interest around mid-2025, raising its ownership in that asset to 75%. In the near- to medium-term, it plans to sell a minority stake in its sports portfolio to institutional investors to help further delever. It will continue working on surfacing value from the sports assets, with long-term options including additional minority stake sales, an IPO, or a full spin-off of the sports portfolio.

Summary

The acquisition of Shaw Communications (a) significantly enhanced the company’s scale, (b) provided access to deep fiber plant across Western Canada, (c) expanded the footprint where RCI could bundle wireless and wireline services, and (d) put the firm in a position to generate meaningful synergies ($1 billion synergy target was achieved one year ahead of schedule). Management doesn’t believe that the firm’s ownership of premier sports assets in Canada (Toronto Blue Jays and stake in MLSE) is adequately reflected in RCI’s current stock price and plans to actively work on surfacing value from these assets over time.

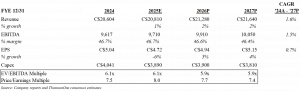

| Table 1 | Rogers Communications |

| Earnings Model 2024 – 2027P |

Ryman Hospitality Properties (RHP – $97.68 – NYSE) Symposium Highlights

| Year | AEBITDA | EV/AEBITDA | |||

| 2027P | $945M | 9.8x | Dividend: $4.60 Current Return: 4.7% | ||

| 2026P | 817 | 11.3 | Shares O/S: 60 million | ||

| 2025E | 779 | 11.9 | 52-Week Range: $121.77 – $76.27 | ||

| 2024A | 758 | 12.2 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Ryman Hospitality Properties, based in Nashville, TN, is a lodging REIT focused on large group-oriented destination hotel assets. The company also owns 70% of the Opry Entertainment Group (OEG), a taxable REIT subsidiary focused on the country music consumer. OEG owns two iconic live entertainment venues in Nashville, the Grand Ole Opry and Ryman Auditorium, as well as Block 21 in Austin, home of Austin City Limits at the Moody Theatre.

Reason for Comment

On June 5, 2025, Ryman’s Executive Chairman Colin Reed and the CEO of the Opry Entertainment Patrick Moore participated in a fireside chat at our 17th Annual Gabelli Media and Sports Conference. Discussion highlights are included below:

- Music festivals are an area for expansion through the newly acquired majority stake in Southern Entertainment. The asset light strategy will allow for accelerating the number of festivals and further geographic expansion. Festivals are a particularly strategic area for OEG given the importance to artists as a larger source of their income mix.

- Management reiterated their intention to eventually separate OEG from the parent REIT. Perhaps the most notable comment came from Ryman CEO Mark Fioravanti during a presentation at REITWeek. While previous statements used general language, Ryman’s CEO made specific reference to OEG being a standalone publicly traded company and an IPO as being the most likely path. To avoid issues with REIT income test limitations, Ryman will likely IPO a small stake in OEG, then in subsequent years continue to sell shares into the market.

Summary

Ryman is the only REIT which focuses on the attractive niche of large group travel, which provides more visibility into future business, recurring revenue characteristics, and low volatility of earnings. Ryman has purpose-built assets to cater to large groups which peers cannot easily replicate given the structural limit to new supply. The Opry Entertainment Group also provides an interesting catalyst to surface value over the next few years as that business should trade at a higher multiple as a stand-alone entity.

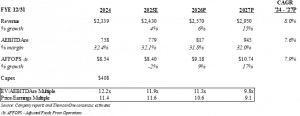

| Table 1 | Ryman Hospitality Properties |

| Earnings Model 2024 – 2027P |

Sinclair, Inc. (SBGI – $13.26 – NASDAQ) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $491M | 9.1x | Dividend: $1.00 Current Return: 7.5% | ||

| 2026P | 760 | 5.9 | Shares Outstanding: 45.8 million Class A (1 Vote) | ||

| 2025E | 476 | 9.4 | 23.8 ” ” B (10 Votes) | ||

| 2024A | 876 | 5.1 | 52-Week Range: $18.45 – $11.13 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

Sinclair is a diversified media company and a leading provider of local news and sports. The company owns, operates and/or provides services to 185 TV stations in 86 markets affiliated with all major broadcast networks that reach roughly 38.5% of U.S. TV households or 25% with the UHF cap. Sinclair also owns Tennis Channel; various multicast networks; and a streaming aggregator of local news content, NewsON. Sinclair’s AMP Media produces a growing portfolio of digital content and podcasts. It was founded in 1971 and is headquartered in Hunt Valley, MD.

Reason for Comment

On June 5, 2025, Sinclair’s President & CEO, Christopher Ripley participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- Following Sinclair’s 2023 corporate restructuring, it operates in two primary businesses: Local Media, the broadcast business, and Sinclair Ventures, a portfolio of assets that includes Tennis Channel, Compulse (a digital marketing platform), and Sinclair’s investment portfolio. Sinclair continues to invest in news and content and make other investments around its core business and adjacencies including NextGen Broadcasting.

- On the current advertising environment, Sinclair noted that certain sectors, like auto and retail, have been affected by tariffs, but most other categories have been up. Given the uncertainty in the broader economy, management is happy with how the market is holding up. Sinclair is also expecting strong 2026 and 2028 political cycles.

- Sinclair has solid visibility into the company’s contractually-backed retransmission revenues and network contracts, with no major renewals until the back of 2026. The company hasn’t had a single blackout in the period and have met or exceeded expectations in each renewal. Net retransmission revenues grew by mid-single digits in Q1 ’25 and Sinclair continues to expect a two-year mid-single digit CAGR through the end of 2025.

- Sinclair is optimistic about real broadcast deregulation under the new FCC, and noted they are actively pursuing low-risk M&A (JSAs, station swaps, etc.) in the interim with eyes on larger transactions pending policy changes.

Summary

There is growing optimism that meaningful broadcast deregulation could be enacted for the first time in years, potentially unlocking new strategic options for Sinclair and the broader local TV broadcast industry. Management remains confident that Sinclair’s current valuation does not fully reflect the intrinsic value of its asset portfolio and believes the company is well positioned to unlock significant shareholder value over time.

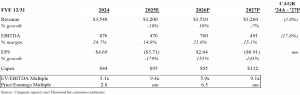

| Table 1 | Sinclair, Inc. |

| Earnings Model 2024 – 2027P |

Sports Investing Panel: Ways to Play

We hosted Sal Galatioto (President, Galatioto Sports Partners), Arun Manikundalam (Dynasty Sports) and Jason Wright (former NFL Running Back / President, Washington Commanders, current Managing Partner, Project Level) for an engaging discussion on current trends in the sports business landscape.

Key Takeaways

- The pipeline of team transactions remains robust and franchise values continue to rise due to a scarcity of supply and a growing universe of buyers. Interest by private equity remains high, especially in light the recent change by NFL to allow up to 10% ownership by PE. A narrow group of firms has dominated minority stake investments though many are raising funds. Sovereigns will inevitably be permitted to invest across the major North American leagues. Notwithstanding these dynamics, wealthy individuals remain the driving force behind transactions.

- Limitations on team purchase price amortization contained in HR1 (the “One Big Beautiful Bill”) have not deterred interest and tax savings has not been a key considerations for most purchasers.

- Team valuations continue to be underpinned by media rights. Sports viewing is irreplaceable – scarce, live and with low acquisition costs (fans are born into their teams). Distribution will evolve as large tech companies bid for rights and viewing migrates to streaming. Sports betting is another major element supporting interest and viewership.

- The NBA will likely expand to Seattle and/or Las Vegas. MLB and the NHL are also actively exploring expansion. However, those franchises will likely come with significant expansion fees to the benefit of existing franchise owners.

- A work stoppage is likely at the conclusion of the current MLB Collective Bargaining Agreement (CBA) in December 2026. Most owners appear united in the desire for a salary cap which should ultimately drive the multiples paid for franchises (currently the lowest on average among the big four professional leagues) much higher.

- Real estate developments such as The Battery in Atlanta are meaningful differentiators and attractive targets for investment by private equity investors.

- A number of emerging sports (e.g. pickleball, flag football, etc.) are competing for consumer attention. However, women’s sports – especially soccer and basketball – possess several durable advantages including demographics and years of parental investment in girls’ sports.

Summary

We continue to view sports-related assets as excellent compounders of value. While local media rights disputes may have added noise to the value of baseball, hockey and basketball teams, consumer demand for this must-see live content remains strong. Newer revenue streams from sponsorship, hospitality, real estate and betting should support continued revenue growth while greater institutional interest in the sector is helping to surface franchise values. At the moment, public market opportunities to invest directly in US sports (Manchester United (MANU) trades in the US while a number of soccer franchises trade on exchanges throughout Europe) are limited to Atlanta Braves Holdings (BATRA/K), Madison Square Garden Sports (MSGS), Formula One (FWONA/K) and TKO Group (TKO).

TEGNA Inc. (TGNA – $16.77 – NYSE) Symposium Highlights

| Year | EBITDA | EV/EBITDA | |||

| 2027P | $641M | 7.9x | Dividend: $0.50 Current Return: 3.0% | ||

| 2026P | 910 | 5.6 | Shares Outstanding: 160.7 million | ||

| 2025E | 584 | 8.7 | 52-Week Range: $19.62 – $12.35 | ||

| 2024A | 931 | 5.4 |

Source: Company data and ThomsonOne consensus estimates.

COMPANY OVERVIEW

TEGNA, headquartered in Tysons, VA, owns and operates 64 TV stations in 51 U.S. markets. The company is the largest owner of Big Four network affiliates in the top 25 markets among independent station groups, reaching ~39% of all television households nationwide. In addition to its broadcast presence, TEGNA connects with over 100 million people monthly through its digital platforms, including web, mobile, streaming services, and over-the-top platforms.

Reason for Comment

On June 5, 2025, TEGNA’s Chief Financial Officer, Julie Heskett participated in a fireside chat at our 17th Annual Media & Sports Symposium. Discussion highlights are included below:

- TEGNA successfully renewed approximately 10% of its traditional MVPD subscribers at the end of Q1 ‘25. The company has another ~45% of its traditional subscribers up for renewal in calendar year 2025, providing the company with additional opportunities to capture appropriate value for its content.

- In terms of core ads, the U.S. economy has been showing mixed signals – in Q1, consumer sentiment was declining but this did not show up in TEGNA’s core advertising results. Unfortunately, this has not held in Q2, and TEGNA noted they are seeing softer and weaker core ads to date.

- Services (TEGNA’s largest category) has remained strong throughout, while auto (the company’s #2 vertical), is holding up at flattish to potentially down slightly. Banking and financial services, healthcare, and retail are other strong categories – likely because these sectors are not directly impacted by tariffs. However, restaurants, entertainment, legal, sports betting, as well as media & telecom are weaker sectors.

- TEGNA is enthusiastic about the potential for meaningful broadcast deregulation, and sees the largest impact from loosening in-market consolidation rules and raising the national ownership cap. TGNA expects Chairman Carr will move quickly once he has a majority and anticipates changes within 12-18 months from there.

- Premion has returned to positive growth despite the national challenges facing the business, and management expects this to accelerate further in 2025, especially when layering in Octillion.

Summary

TEGNA has an industry-leading balance sheet and expects to remain comfortably within the 2-3x’s leverage range, even after returning significant capital to shareholders following the termination of the Standard General merger process in 2023. We expect TGNA to be a beneficiary of broadcast deregulation and resulting industry consolidation.

| Table 1 | TEGNA Inc. |

| Earnings Model 2024 – 2027P |

Television Bureau of Advertising Panel Symposium Highlights

TVB OVERVIEW

TVB is the not-for-profit trade association representing America’s local broadcast television industry. Its members include the U.S. television stations, television broadcast groups, advertising sales reps, syndicators, international broadcasters, and associate members. TVB actively promotes local media marketing solutions to the advertising community and works to develop advertising dollars for the medium’s multiple platforms, including on-air, online, and mobile. TVB provides a diverse variety of tools and resources, including its website, to support its members and to help advertisers make the best use of local ad dollars.

Reason for Comment

On June 5, 2025, TVB’s President & CEO, Steve Lanzano participated in a fireside chat at our 177h Annual Media & Sports Symposium to discuss trends, opportunities, and challenges in local television. Highlights from the discussion are included below:

- Local TV is primarily a sports and news game today. Sports are viewed as the largest entertainment battleground as media, internet, and tech players vie for content. Local sports have been moving to local, and leagues/teams balance revenue maximization with reach concerns as eyeballs move from linear to streaming.

- The advertising backdrop has been more challenged recently amid the current macro, tariff dynamics, and uncertainty. In terms of categories, auto is still between 15-20% a typical broadcasters’ business vs. over 25% historically. Fears over tariffs have been driving early purchases, reducing incentives. Legal/attorneys, which generally account for ~10% of the mix) are still spending, as is home improvement and farming.

- The intensely polarized political landscape and number of competitive races continued to drive high-margin political advertising spend industry-wide, and TVB is optimistic that 2026 and 2028 political could approach or even surpass record levels for midterms and presidential cycles, respectively.

- TVB is optimistic that there will be changes to existing rules near-term under new FCC Commissioner Brendan Carr. Accordingly, large-scale broadcast M&A could begin to pick back up.

- Another topic that continues to get attention is NextGen TV or ATSC 3.0, which is seeing continued momentum. Several use cases using the new transmission standard were discussed, including broadband data off-loading, and automotive applications related to over the air software updates and navigation. It will likely be at least a few more years before the industry begins to show material non-broadcast–correlated revenue and several years beyond that until it could potentially be a meaningful contributor. Barriers to more rapid scaling include chip set adoption, both in television sets (already slowly underway) and other end markets (automotive). While the related sun-setting of ATSC 1.0, which would free up more additional spectrum, has also been viewed as a barrier, this is expected to accelerate materially under FCC Chairman Carr’s leadership.

- TVB is developing a platform to enable programmatic buying and selling of local TV advertising. This platform will allow advertisers to purchase local TV inventory through automated, data-driven systems. The goal is to make it easier for advertisers, especially those who don’t traditionally buy local TV, to access the medium. The platform will offer advertisers full visibility into inventory and pricing, as well as the ability to set their own criteria for accepting or rejecting offers. The platform is expected to be available for testing in late fall, with a target launch date of January 1, 2026.

Summary

Local broadcasters are better-positioned to weather an advertising recession today than in prior periods, and TVB is seeing some positive momentum in terms of core advertising more recently. In addition, the industry continues to expect strong political spending during the upcoming 2026 midterms election cycle. Under the new FCC and administration, regulatory changes are likely, which is expected to open up the potential for larger-scale broadcast M&A. In addition, TVB continues to see a number of other opportunities for the local broadcast sector ahead, including NextGen TV or ATSC 3.0.

191 MASON STREET RYE, NY 10580 Gabelli Funds TEL (914) 921-5000

As of March 31, 2025, affiliates of GAMCO Investors, Inc. beneficially own on behalf of their investment advisory clients or otherwise approximately 31.43% of Atlanta Braves Class A, 6.32% of Class C, 11.32% of Sinclair, 5.41% of E.W. Scripps, 2.41% of TEGNA, 2.25% of Ryman Hospitality, and less than 1% of all other companies mentioned

This document is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

Investors should consider the investment objectives, risks, sales charges and expense of the fund carefully before investing.

Gabelli Funds, LLC is a registered investment adviser with the U.S. Securities and Exchange Commission. Gabelli Funds provides discretionary investment advisory services primarily to open and closed-end investment companies. Gabelli Funds is a wholly owned subsidiary of GAMCO Investors, Inc. (“GAMCO Investors”), a Delaware corporation whose stock is traded on OTC Markets (OTCQX:GAMI).

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com