Cap Off, Game On: Broadcast Deregulation & Consolidation Ahead

OVERVIEW

Local television broadcasters in the U.S. have long been limited by FCC rules designed to preserve localism and media diversity – most notably, the national ownership cap, which restricts station groups to reaching 39% of total U.S. TV households. However, in a media landscape now dominated by streaming platforms and big tech, many of these restrictions are increasingly outdated and misaligned with market dynamics. Under new FCC Commissioner Brendan Carr, momentum is building for a broad deregulatory push – one that could ease national and local ownership limitations, allow direct negotiations with virtual MVPDs, reform reverse-retransmission rules, and sunset ATSC 1.0 in favor of next-gen broadcast standards. This paper outlines the regulatory shifts underway and explores the strategic implications for the local broadcast sector in light of these potential changes.

Overview of Broadcast Ownership Rules

For decades, the FCC’s broadcast ownership rules have enforced limits on television station consolidation, reflecting longstanding concerns about media diversity and local control. Restrictions around national audience reach and local ownership remain in place, alongside rules that ban any single company owning multiple major TV networks.

- National Television Ownership Cap: a national television ownership cap limits the cumulative reach of TV stations that one company can own across the country. Since 2004, federal law has set this cap at 39% of U.S. TV households. The FCC historically enforced this limit, including policies like the now-defunct ‘UHF discount’ that once allowed certain stations to count less toward the cap.

- Local Television Ownership: the FCC’s local television ownership rule limits how many stations a single company can control in the same market. Since 1999, ownership of two stations has only been allowed if one is not among the top four in local ratings and at least eight independently owned, full-power stations remain in the market post-merger. These restrictions have historically blocked combinations between Big Four network affiliates in a given market. While the FCC eliminated the ‘eight voices’ test in 2017 and introduced case-by-case waiver reviews for the top-four rule, the core limitation – no common ownership of two top-four stations in a market – remains. Originally intended to preserve editorial diversity and curb local ad market concentration, these caps persist despite sweeping changes in how local content is distributed and consumed.

- Top Four Network Ownership Rule: the FCC has long prohibited mergers among any of the Big Four television networks (ABC, CBS, NBC, and FOX). In effect, no single company can own more than one of these major national networks. Together, the national cap and the dual-network prohibition were designed to maintain a competitive balance and a diversity of information sources at the national level.

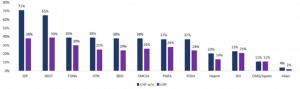

Exhibit 1 – Local Station Groups – U.S. TV Household Reach

Source: Company reports, Gabelli Funds estimates.

Deregulation is expected to accelerate industry consolidation, with acquirers continuing to realize synergies from several key areas: after-acquired rights, in-market efficiencies, and the reduction of back-office and redundant corporate costs. While after-acquired rights (contractually stepping up a target’s retransmission rates to those of the acquirer) have historically driven the largest and most immediate EBITDA uplift, the disparity in rates among major broadcasters has narrowed in recent years. As a result, in-market synergies are now seen as the most compelling value driver. These include headcount reductions, but also more meaningful savings from the consolidation of master control operations, broadcast infrastructure, and real estate.

FCC & Commissioner Brendan Carr’s Regulatory Stance & Proposals

Appointed to the FCC in 2017 and now serving as the FCC’s Republican Chairman, Brendan Carr has made clear through speeches and interviews that he believes many broadcast rules are antiquated. His approach involves relaxing ownership limits, altering network/affiliate dynamics, and accelerating technology transitions. Carr has characterized the existing local station ownership limits as outdated constraints that undermine broadcasters’ ability to succeed. He notes that Big Tech and national media companies face no equivalent limits on audience size or advertising reach, while local TV groups remain bound by ‘arcane, artificial limits’ on how many stations they can own. Carr argues that many local broadcasters are relatively small businesses competing against tech platforms like Google and Facebook in the advertising arena; loosening ownership caps could help even the playing field by permitting local media to grow and achieve efficiencies.

Enabling Direct Negotiations with Virtual MVPDs (vMVPDs)

Another key pillar of Commissioner Carr’s agenda is giving local broadcasters more control over carriage negotiations with vMVPDs (e.g., YouTube TV, Hulu + Live TV). Today, these deals are typically struck by national networks, leaving local affiliates sidelined and with limited revenue participation. In a 2024 joint FCC filing, major affiliate groups argued that vMVPDs won’t even engage with individual stations, locking them into unfavorable, network-led agreements. Carr has expressed support for reclassifying these virtual MVPDs as MVPDs under FCC rules, a move that would require them to negotiate retransmission consent directly with local stations, as traditional cable and satellite operators do. This shift would unlock new revenue streams for local broadcasters, enable market-specific dealmaking, and give affiliates greater control over digital distribution. In Carr’s view, restoring negotiation rights is essential to strengthening the financial sustainability of local journalism in the streaming era.

Accelerating the Transition to ATSC 3.0 (NextGen TV)

Commissioner Carr has voiced strong support for accelerating the rollout of ATSC 3.0, the next-generation broadcast standard known as ‘NextGen TV.’ Offering 4K video, immersive audio, mobile reception, and advanced data services, ATSC 3.0 has the potential to enhance the consumer experience and unlock new revenue streams for broadcasters. However, progress has been slowed by FCC rules requiring stations to simulcast in both ATSC 3.0 and the legacy 1.0 format with substantially similar content, creating costly, resource-intensive dual operations. Carr has signaled a willingness to phase out these mandates. The FCC recently opened a public comment period on a National Association of Broadcasters (NAB) petition proposing a formal transition timeline, with completion in the top 55 markets by 2028 and nationwide by 2030. Sunsetting ATSC 1.0 would eliminate regulatory friction, push industry-wide adoption of the new standard, and enable broadcasters to fully leverage ATSC 3.0 for innovation ranging from enhanced TV to datacasting and connected services. Carr views this modernization as essential to keeping local broadcasting competitive and commercially viable in a rapidly evolving media landscape.

Conclusion

FCC Commissioner Carr’s deregulatory agenda is setting the stage for a major shift in the local broadcast landscape. Easing ownership caps, restoring direct negotiation rights with vMVPDs, and accelerating the ATSC 3.0 transition collectively represent a policy agenda designed to modernize the broadcast industry. If enacted, these changes could unlock significant consolidation opportunities, improve operating efficiency, and position local broadcasters to compete more effectively in a digital-first media landscape.

Hanna Howard

©Gabelli Funds 2025

(914) 921-5015

hhoward@gabelli.com

191 Mason Street, Greenwich, CT 06830

Gabelli Funds

TEL (914) 921-5000

This whitepaper was prepared by Hanna Howard. The examples cited herein are based on public information and we make no representations regarding their accuracy or usefulness as precedent. The Research Analyst’s views are subject to change at any time based on market and other conditions. The information in this report represent the opinions of the individual Research Analyst’s as of the date hereof and is not intended to be a forecast of future events, a guarantee of future results, or investments advice. The views expressed may differ from other Research Analyst or of the Firm as a whole.

This whitepaper is not an offer to sell any security nor is it a solicitation of an offer to buy any security.

Investors should consider the investment objectives, risks, sales charges and expense of the fund carefully before investing.

For more information, visit our website at: www.gabelli.com or call: 800-GABELLI

800-422-3554 • 914-921-5000 • Fax 914-921-5098 • info@gabelli.com