-

Login

Driving Capital Appreciation While Building a Sustainable Future

XXXXXXXXX

The Love Our Planet & People (LOPP) ETF seeks to invest in companies committed to sustainable practices such as renewable energy, reduction or recycling of long-lived water conservation wastes and clean mobility. The Fund aims to achieve its objective by investing substantially all, and in any case no less than 80%, of its assets in U.S. exchange-listed common and preferred stocks of companies that meet the Fund’s guidelines for sustainability at the time of investment.

LOPP’s investment objective is capital appreciation.

Purpose-driven Investments: By combining financial growth with sustainability and ethical values, the Fund empowers investors to align their portfolios with a positive impact on society while pursuing strong returns.

Deep and Disciplined: The Fund utilizes our Private Market Value with a Catalyst™ approach to determine the price a strategic buyer would be willing to pay for the entire company and potential catalysts, such as buyouts or management changes, that could surface the unlocked value of the company.

atokar@gabelli.com (914) 457-1079

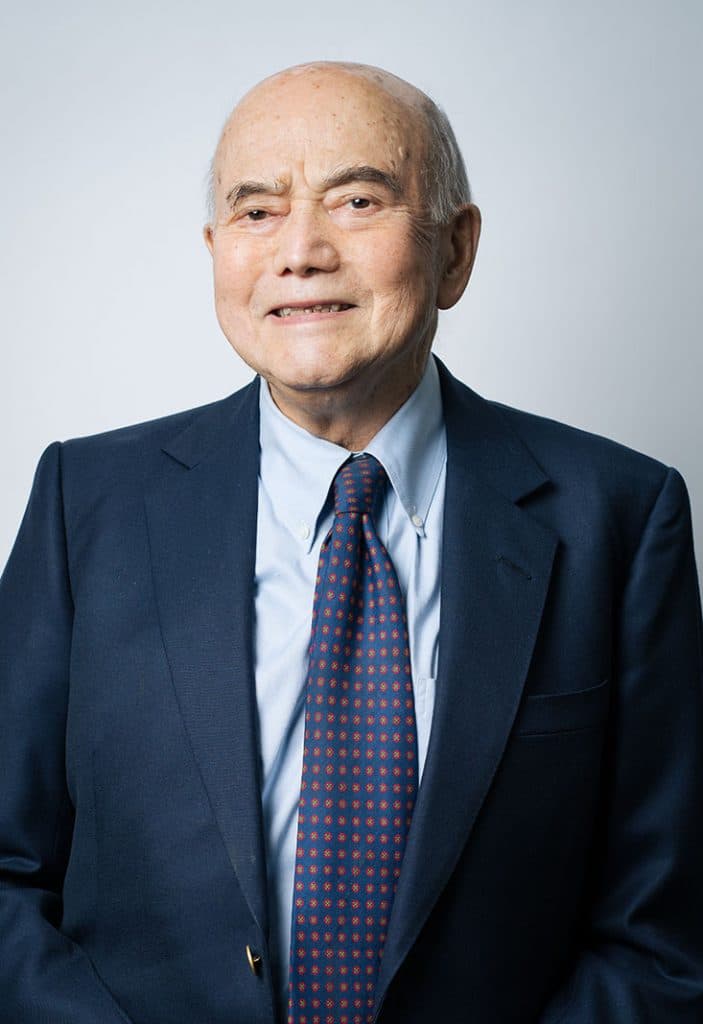

Peter Tcherepnine joined the firm as a Senior Vice President in 2019. He was born and educated in France and the United States and became a U.S. citizen in 1960. After graduating from Harvard University with a B.A. degree and serving for two years as an officer in the U.S. Army Artillery, he joined Loeb,… More

jtate@gabelli.com (914) 921-8349

Christopher E. Tangorra is an Executive Vice President and Director of Operations at Gabelli, where he manages the Global Operations Department. He also oversees certain aspects of the day-to-day operations of the firm. With 28 of experience in operations and automation, Mr. Tangorra specializes in making the firm’s processes more efficient using technology. Some of… More

Macrae Sykes is a portfolio manager of the Gabelli Equity Trust (GAB) and for individual separately managed accounts. He is the sole portfolio manager for the Gabelli Financial Services Opportunities ETF, an active, transparent fund listed on the NYSE (GABF). Mac joined the firm in 2008 as an analyst focused on financial services. Macrae was… More

PSwirbul@gabelli.com (914) 921-5084

ahelm@gabelli.com (914) 921-5081

Supported by a centralized team of 30+ sector-focused analysts supporting Growth and Value portfolios

A graphical measurement of a portfolio’s net return that simulates the performance of an initial investment of $10,000 over the given time period.

Returns represent past performance and do not guarantee future results. Due to market volatility, current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so, upon redemption, shares may be worth more or less than their original cost. To obtain the most recent month end performance information and a prospectus, please call 800-GABELLI or visit www.gabelli.com

Returns represent past performance and do not guarantee future results. Due to market volatility, current performance may be lower or higher than the performance data quoted. Total return and average annual returns are historical and reflect changes in share price, reinvestment of dividends and capital gains and are net of expenses. Investment return and principal value will fluctuate so, upon redemption, shares may be worth more or less than their original cost. To obtain the most recent month end performance information and a prospectus, please call 800-GABELLI or visit www.gabelli.com.

Download daily holdings file.

Download daily holdings file.

Download daily holdings file.

Gross Expense Ratio

Net Expense Ratio

Maximum Sales Charge